-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Australian PM seeks removal of UK's Andrew from line of succession

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

N.Korea leader's sister promoted at party congress

-

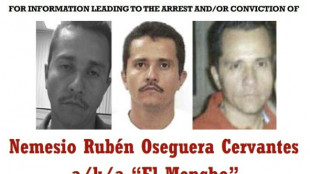

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

US forces to complete withdrawal from Syria within a month

-

US winter storm brings rare hush to snowy New York

-

George adamant Six Nations losses don't make England 'a bad team overnight'

George adamant Six Nations losses don't make England 'a bad team overnight'

-

US Supreme Court to hear bid to block climate change suits

-

Canada summons OpenAI over failure to report mass shooter

Canada summons OpenAI over failure to report mass shooter

-

From Odesa to Bakhmut, revisiting a Ukrainian family torn by war

-

Vonn says Olympic injury could have led to amputation

Vonn says Olympic injury could have led to amputation

-

UK police arrest ex-envoy Peter Mandelson in Epstein case

-

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

Trump either a 'traitor' or 'exceptional', Nobel-winner Walesa tells AFP

-

Son of director Rob Reiner pleads not guilty to parents' murder

-

Panama takes control of canal ports from CK Hutchison

Panama takes control of canal ports from CK Hutchison

-

Risk of 'escalation' if Iran attacked: deputy foreign minister

-

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

West Indies thrash Zimbabwe at T20 World Cup after piling up 254-6

-

US forces to complete withdrawal from Syria within a month: sources to AFP

-

Snowstorm blankets US northeast as New York sees travel ban

Snowstorm blankets US northeast as New York sees travel ban

-

Healthcare crisis looms over Greenland's isolated villages

-

Hodgkinson says breaking 800m record would put her among athletics' greatest

Hodgkinson says breaking 800m record would put her among athletics' greatest

-

Two Russian security personnel were on board France-seized tanker: sources

-

EU puts US trade deal on ice after Supreme Court ruling

EU puts US trade deal on ice after Supreme Court ruling

-

Hetmyer blasts 85 as West Indies pile up 254-6 against Zimbabwe

-

Canada PM heads to Asia seeking new trade partners as US ties fray

Canada PM heads to Asia seeking new trade partners as US ties fray

-

South Africa accepts Trump's new US ambassador

-

Iraq's Maliki defends PM candidacy, seeks to reassure US

Iraq's Maliki defends PM candidacy, seeks to reassure US

-

UEFA suspend Benfica's Prestianni after alleged racist abuse

-

Jetten sworn in as youngest-ever Dutch PM

Jetten sworn in as youngest-ever Dutch PM

-

Italy's Enel to invest 20bn euros in renewables by 2028

-

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

BBC apologises for 'involuntary' Tourette's racial slur during BAFTA awards

-

Kristen Bell returns to host glitzy Actor Awards in Hollywood

-

Iran says would respond 'ferociously' to any US attack

Iran says would respond 'ferociously' to any US attack

-

Venezuelan foreign minister demands 'immediate release' of Maduro

-

Dane Vingegaard to start season at Paris-Nice in March

Dane Vingegaard to start season at Paris-Nice in March

-

Australia PM backs removing UK's Andrew from line of succession

Innodata Reports Third Quarter 2025 Results

Revenue up 20% Year-Over-Year

Reiterates Prior Guidance of 45% or More YoY Growth in 2025

Anticipates Transformative Growth in 2026 Based on New Wins and Strong Momentum

NEW YORK CITY, NY / ACCESS Newswire / November 6, 2025 / INNODATA INC. (Nasdaq:INOD) today reported results for the third quarter ended September 30, 2025.

Revenue of $62.6 million for the three months ended September 30, 2025, representing 20% year-over-year organic revenue growth.

Revenue of $179.3 million for the nine months ended September 30, 2025, representing 61% year-over-year organic revenue growth.

Adjusted EBITDA of $16.2 million for the three months ended September 30, 2025, an increase of $2.3 million, or 17%, from $13.9 million in the same period last year.*

Adjusted EBITDA of $42.2 million for the nine months ended September 30, 2025, an increase of $21.8 million, or 106%, from $20.4 million in the same period last year.*

Net income of $8.3 million, or $0.26 per basic share and $0.24 per diluted share, for the three months ended September 30, 2025, compared to net income of $17.4 million, or $0.60 per basic share and $0.51 diluted share, in the same period last year. The prior-year period's earnings per share benefited by approximately $0.34 basic and $0.27 diluted from a tax benefit related to the utilization of net operating loss carryforwards (NOLCOs).

Net income of $23.3 million, or $0.74 per basic share and $0.67 per diluted share, for the nine months ended September 30, 2025, compared to net income of $18.4 million, or $0.64 per basic share and $0.55 per diluted share, in the same period last year. The prior-year period's earnings per share benefited by approximately $0.18 basic and $0.16 diluted from a tax benefit related to the utilization of NOLCOs.

Cash, cash equivalents and short-term investments were $73.9 million as of September 30, 2025 and $46.9 million as of December 31, 2024.

* Adjusted EBITDA is defined below.

Jack Abuhoff, CEO, said, "Our third quarter marked another record-setting performance for Innodata, with revenue, profitability, and cash all at all-time highs. Looking ahead, in 2026, we anticipate a continuation of our transformative growth, fueled by (1) deepening relationships with the world's leading Big Tech and AI innovation labs, as evidenced by verbal confirmation of an expansion with our largest customer that could potentially result in substantial revenue, verbal confirmation of a deal with another Big Tech which could potentially result in $6.5 million of annualized revenue runrate, and five new Big Tech customers we have either landed or expect to finalize shortly, two of which are global leaders in commerce, cloud and AI; and (2) strong early returns from seven major investment areas, several of which we are announcing today, including:

Pre-Training Data: Earlier this year we recognized that model quality is increasingly tied to the quality of pre-training data. Acting early, we invested in new pre-training data capabilities, and that bet is already paying off. We've since signed contracts we believe could result in approximately $42 million of revenue, and we expect to soon sign contracts we believe could result in approximately $26 million of additional revenue. So that's $68 million of potential revenue from these programs that are either signed or likely to be signed soon. These programs are ramping now.

Federal Practice: As announced today, we have launched Innodata Federal, led by AI veterans with deep defense and intelligence experience. The business unit has engaged a new, high-profile customer. We believe the initial project with this customer will result in approximately $25 million of revenue, mostly in 2026. We have additional projects under discussion with this customer. We see this new relationship as a potential major catalyst for growth and visibility as the U.S. government accelerates AI adoption across agencies.

As we announced today, General (Retired) Richard D. Clarke, a retired four-star Army general and former Commander of U.S. Special Operations Command, has joined the Innodata board. We are excited about his expertise and relationships in helping guide the trajectory of Innodata Federal.

Sovereign AI: Around the world, governments are moving to build sovereign AI capability - controlling the full technology stack from silicon to data. Innodata is in active discussions with several sovereign AI programs and expects to announce one or more strategic partnerships in 2026. We view this as one of the most significant structural shifts in the global AI ecosystem and an enormous medium-term opportunity for us.

Enterprise AI: Our Enterprise AI Practice helps companies embed generative AI into products and operations. We're working with major platforms to automate workflows, integrate real-time analytics into data-center operations, and re-engineer business processes using GenAI. We're pleased with the rapid acceleration in business we are experiencing in this market.

Agentic AI: We believe Agentic AI will unlock the next wave of enterprise productivity. We're working with leading companies to develop and benchmark autonomous agents across real-world use cases - measuring consistency, reliability, and efficiency.

Model Safety: As models and agents gain autonomy, ensuring safety, reliability, and ethical integrity becomes mission critical. We're engaged with leading companies to stress-test their multimodal AI products against risks like data exfiltration, instruction manipulation, and privilege escalation. Our work in this area is informed by insights we have gathered and technologies we have developed working with frontier model builders.

Based on updated forecasts, we reiterate guidance we provided last quarter of 45% or more year-over-year organic revenue growth in 2025, and we anticipate continued transformative growth in 2026 based on new wins and strong momentum."

Abuhoff concluded, "Taken together, we believe the developments we are announcing today mark a company entering its next phase of transformative growth - profitable, increasingly diversified, and positioned squarely at the center of the AI revolution."

Amounts in this press release have been rounded. All percentages have been calculated using unrounded amounts.

Timing of Conference Call with Q&A

Innodata will conduct an earnings conference call, including a question-and-answer period, at 5:00 PM eastern time today. You can participate in this call by dialing the following call-in numbers:

The call-in numbers for the conference call are:

(+1) 800 549 8228 North America

(+44) 800 279 7040 United Kingdom

(+1) 289 819 1520 International

Participant Access Code 42719 #

Replay dial-In

(+1) 888 660 6264 North America

(+1) 289 819 1325 International:

Replay Passcode 42719 #

It is recommended that participants dial in approximately 10 minutes prior to the start of the call. Investors are also invited to access a live Webcast of the conference call at the Investor Relations section of Innodata's website at https://investor.innodata.com/events-and-presentations/. Please note that the Webcast feature will be in listen-only mode.

Call-in replay will be available for seven days following the conference call, and Webcast replay will be available for 30 days following the conference call, at the Investor Relations section of Innodata's website at https://investor.innodata.com/events-and-presentations/.

About Innodata

Innodata (Nasdaq: INOD) is a global data engineering company. We believe that data and Artificial Intelligence (AI) are inextricably linked. That's why we're on a mission to help the world's leading technology companies and enterprises drive Generative AI / AI innovation. We provide a range of transferable solutions, platforms, and services for Generative AI / AI builders and adopters. In every relationship, we honor our 35+ year legacy delivering the highest quality data and outstanding outcomes for our customers.

Visit www.innodata.com to learn more.

Forward-Looking Statements

This press release may contain certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. These forward-looking statements include, without limitation, statements concerning our operations, economic performance, financial condition, developmental program expansion and position in the generative AI services market. Words such as "project," "forecast," "believe," "expect," "can," "continue," "could," "intend," "may," "should," "will," "anticipate," "indicate," "guide," "predict," "likely," "estimate," "plan," "potential," "possible," "promises," or the negatives thereof, and other similar expressions generally identify forward-looking statements.

These forward-looking statements are based on management's current expectations, assumptions and estimates and are subject to a number of risks and uncertainties, including, without limitation, impacts resulting from ongoing geopolitical conflicts; investments in large language models; that contracts may be terminated by customers; projected or committed volumes of work may not materialize; pipeline opportunities and customer discussions which may not materialize into work or expected volumes of work; the likelihood of continued development of the markets, particularly new and emerging markets, that our services support; the ability and willingness of our customers and prospective customers to execute business plans that give rise to requirements for our services; continuing reliance on project-based work in the Digital Data Solutions ("DDS") segment and the primarily at-will nature of such contracts and the ability of these customers to reduce, delay or cancel projects; potential inability to replace projects that are completed, canceled or reduced; our DDS segment's revenue concentration in a limited number of customers; our dependency on content providers in our Agility segment; our ability to achieve revenue and growth targets; difficulty in integrating and deriving synergies from acquisitions, joint ventures and strategic investments; potential undiscovered liabilities of companies and businesses that we may acquire; potential impairment of the carrying value of goodwill and other acquired intangible assets of companies and businesses that we acquire; a continued downturn in or depressed market conditions; changes in external market factors; the potential effects of U.S. global trading and monetary policy, including the interest rate policies of the Federal Reserve; changes in our business or growth strategy; the emergence of new, or growth in existing competitors; various other competitive and technological factors; our use of and reliance on information technology systems, including potential security breaches, cyber-attacks, privacy breaches or data breaches that result in the unauthorized disclosure of consumer, customer, employee or Company information, or service interruptions; and other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission ("SEC").

Our actual results could differ materially from the results referred to in any forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the risks discussed in Part I, Item 1A. "Risk Factors," Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations," and other parts of our Annual Report on Form 10-K, filed with the SEC on February 24, 2025, and in our other filings that we may make with the SEC. In light of these risks and uncertainties, there can be no assurance that the results referred to in any forward-looking statements will occur, and you should not place undue reliance on these forward-looking statements. These forward-looking statements speak only as of the date hereof.

We undertake no obligation to update or review any guidance or other forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by the U.S. federal securities laws.

Company Contact

Aneesh Pendharkar

[email protected]

(201) 371-8000

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity with U.S. GAAP ("GAAP"), we provide certain non-GAAP financial information. We believe that these non-GAAP financial measures assist investors in making comparisons of period-to-period operating results. In some respects, management believes non-GAAP financial measures are more indicative of our ongoing core operating performance than their GAAP equivalents by making adjustments that management believes are reflective of the ongoing performance of the business.

We believe that the presentation of this non-GAAP financial information provides investors with greater transparency by providing investors a more complete understanding of our financial performance, competitive position, and prospects for the future, particularly by providing the same information that management and our Board of Directors use to evaluate our performance and manage the business. However, the non-GAAP financial measures presented in this press release have certain limitations in that they do not reflect all of the costs associated with the operations of our business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. Further, the non-GAAP financial measures that we present may differ from similar non-GAAP financial measures used by other companies.

Adjusted Gross Profit and Adjusted Gross Margin

We define Adjusted Gross Profit as revenues less direct operating costs attributable to Innodata Inc. and its subsidiaries in accordance with U.S. GAAP, plus depreciation and amortization of intangible assets, stock-based compensation, non-recurring severance and other one-time costs included within direct operating cost.

We define Adjusted Gross Margin by dividing Adjusted Gross Profit over total U.S. GAAP revenues.

We use Adjusted Gross Profit and Adjusted Gross Margin to evaluate results of operations and trends between fiscal periods and believe that these measures are important components of our internal performance measurement process.

A reconciliation of Adjusted Gross Profit and Adjusted Gross Margin to the most directly comparable GAAP measure is included in the tables that accompany this release.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) attributable to Innodata Inc. and its subsidiaries in accordance with U.S. GAAP before interest expense, income taxes, depreciation and amortization of intangible assets (which derives EBITDA), plus additional adjustments for loss on impairment of intangible assets and goodwill, stock-based compensation, income (loss) attributable to non-controlling interests, non-recurring severance, and other one-time costs.

We use Adjusted EBITDA to evaluate core results of operations and trends between fiscal periods and believe that these measures are important components of our internal performance measurement process.

A reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure is included in the tables that accompany this release.

INNODATA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per-share amounts)

Three Months Ended | Nine Months Ended | ||||||||||

September 30, | September 30, | ||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||

Revenues | $ | 62,550 | $ | 52,224 | $ | 179,287 | $ | 111,281 | |||

Operating costs and expenses: | |||||||||||

Direct operating costs | 37,046 | 30,893 | 107,508 | 70,964 | |||||||

Selling and administrative expenses | 13,745 | 9,910 | 42,837 | 27,235 | |||||||

Interest income, net | (420) | (26) | (1,124) | (55 | ) | ||||||

50,371 | 40,777 | 149,221 | 98,144 | ||||||||

Income before provision for income taxes | 12,179 | 11,447 | 30,066 | 13,137 | |||||||

Provision for income taxes | 3,837 | (5,944 | ) | 6,718 | (5,235 | ) | |||||

Consolidated net income | 8,342 | 17,391 | 23,348 | 18,372 | |||||||

Income attributable to non-controlling interests | - | 2 | - | 8 | |||||||

Net income attributable to Innodata Inc. and Subsidiaries | $ | 8,342 | $ | 17,389 | $ | 23,348 | $ | 18,364 | |||

Income per share attributable to Innodata Inc. and Subsidiaries: | |||||||||||

Basic | $ | 0.26 | $ | 0.60 | $ | 0.74 | $ | 0.64 | |||

Diluted | $ | 0.24 | $ | 0.51 | $ | 0.67 | $ | 0.55 | |||

Weighted average shares outstanding: | |||||||||||

Basic | 31,848 | 28,994 | 31,690 | 28,873 | |||||||

Diluted | 35,266 | 34,007 | 34,996 | 33,297 | |||||||

INNODATA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

September 30, 2025 | December 31, 2024 | |||

ASSETS | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 73,859 | $ | 46,897 |

Accounts receivable, net | 39,440 | 28,013 | ||

Prepaid expenses and other current assets | 6,478 | 6,090 | ||

Total current assets | 119,777 | 81,000 | ||

Property and equipment, net | 7,143 | 4,101 | ||

Right-of-use asset, net | 4,332 | 4,238 | ||

Other assets | 1,524 | 1,267 | ||

Deferred income taxes, net | 4,188 | 7,492 | ||

Intangibles, net | 13,885 | 13,353 | ||

Goodwill | 2,067 | 1,998 | ||

Total assets | $ | 152,916 | $ | 113,449 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

Current liabilities: | ||||

Accounts payable, accrued expenses and other | $ | 23,711 | $ | 17,455 |

Accrued salaries, wages and related benefits | 15,262 | 13,836 | ||

Income and other taxes | 3,205 | 5,695 | ||

Long-term obligations - current portion | 1,221 | 1,643 | ||

Operating lease liability - current portion | 1,122 | 877 | ||

Total current liabilities | 44,521 | 39,506 | ||

Deferred income taxes, net | 40 | 32 | ||

Long-term obligations, net of current portion | 7,560 | 6,744 | ||

Operating lease liability, net of current portion | 3,555 | 3,778 | ||

Total liabilities | 55,676 | 50,060 | ||

STOCKHOLDERS' EQUITY | 97,240 | 63,389 | ||

Total liabilities and stockholders' equity | $ | 152,916 | $ | 113,449 |

INNODATA INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Nine Months Ended | |||||

September 30, | |||||

2025 | 2024 | ||||

Cash flows from operating activities: | |||||

Consolidated net income | $ | 23,348 | $ | 18,372 | |

Adjustments to reconcile consolidated net income to net cash | |||||

provided by operating activities: | |||||

Stock-based compensation | 8,309 | 2,881 | |||

Depreciation and amortization | 4,913 | 4,219 | |||

Deferred income taxes | 3,201 | (6,153 | ) | ||

Pension cost | 984 | 948 | |||

Loss on lease termination | |||||

Changes in operating assets and liabilities: | |||||

Accounts receivable | (11,167) | (8,834 | ) | ||

Prepaid expenses and other current assets | (299) | (1,222 | ) | ||

Other assets | (248) | 673 | |||

Accounts payable and accrued expenses | 5,963 | 4,869 | |||

Accrued salaries, wages and related benefits | 1,397 | 1,822 | |||

Income and other taxes | (2,530) | 109 | |||

Net cash provided by operating activities | 33,871 | 17,684 | |||

Cash flows from investing activities: | |||||

Capital expenditures | (8,286) | (5,522 | ) | ||

Net cash used in investing activities | (8,286) | (5,522 | ) | ||

Cash flows from financing activities: | |||||

Proceeds from exercise of stock options | 1,548 | 810 | |||

Withholding taxes on net settlement of restricted stock units | (37) | (97 | ) | ||

Payment of long-term obligations | (369) | (516 | ) | ||

Net cash provided by financing activities | 1,142 | 197 | |||

Effect of exchange rate changes on cash and cash equivalents | 235 | 199 | |||

Net increase in cash and cash equivalents | 26,962 | 12,558 | |||

Cash and cash equivalents, beginning of period | 46,897 | 13,806 | |||

Cash and cash equivalents, end of period | $ | 73,859 | $ | 26,364 | |

INNODATA INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

(In thousands)

Adjusted Gross Profit and Adjusted Gross Margin

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Consolidated | 2025 | 2024 | 2025 | 2024 | ||||||||

Gross Profit attributable to Innodata Inc. and Subsidiaries | $ | 25,504 | $ | 21,331 | $ | 71,779 | $ | 40,317 | ||||

Depreciation and amortization | 1,729 | 1,513 | 4,855 | 4,147 | ||||||||

Stock-based compensation | 444 | 43 | 1,312 | 200 | ||||||||

Adjusted Gross Profit | $ | 27,677 | $ | 22,887 | $ | 77,946 | $ | 44,664 | ||||

Gross Margin | 41 | % | 41 | % | 40 | % | 36 | % | ||||

Adjusted Gross Margin | 44 | % | 44 | % | 43 | % | 40 | % | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

DDS Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Gross Profit attributable to DDS Segment | $ | 22,152 | $ | 17,610 | $ | 61,281 | $ | 30,247 | ||||

Depreciation and amortization | 800 | 648 | 2,224 | 1,441 | ||||||||

Stock-based compensation | 433 | 38 | 1,278 | 176 | ||||||||

Adjusted Gross Profit | $ | 23,385 | $ | 18,296 | $ | 64,783 | $ | 31,864 | ||||

Gross Margin | 40 | % | 39 | % | 39 | % | 34 | % | ||||

Adjusted Gross Margin | 43 | % | 41 | % | 41 | % | 35 | % | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Synodex Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Gross Profit attributable to Synodex Segment | $ | 117 | $ | 483 | $ | 1,116 | $ | 1,338 | ||||

Depreciation and amortization | 114 | 112 | 289 | 406 | ||||||||

Stock-based compensation | - | 1 | 1 | 1 | ||||||||

Adjusted Gross Profit | $ | 231 | $ | 596 | $ | 1,406 | $ | 1,745 | ||||

Gross Margin | 7 | % | 25 | % | 19 | % | 23 | % | ||||

Adjusted Gross Margin | 14 | % | 31 | % | 25 | % | 30 | % | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Agility Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Gross Profit attributable to Agility Segment | $ | 3,235 | $ | 3,238 | $ | 9,382 | $ | 8,732 | ||||

Depreciation and amortization | 815 | 753 | 2,342 | 2,300 | ||||||||

Stock-based compensation | 11 | 4 | 33 | 23 | ||||||||

Adjusted Gross Profit | $ | 4,061 | $ | 3,995 | $ | 11,757 | $ | 11,055 | ||||

Gross Margin | 53 | % | 58 | % | 54 | % | 56 | % | ||||

Adjusted Gross Margin | 66 | % | 71 | % | 68 | % | 71 | % | ||||

INNODATA INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

(In thousands)

Adjusted EBITDA

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Consolidated | 2025 | 2024 | 2025 | 2024 | ||||||||

Net income attributable to Innodata Inc. and Subsidiaries | $ | 8,342 | $ | 17,389 | $ | 23,348 | $ | 18,364 | ||||

Provision for income taxes | 3,837 | (5,944 | ) | 6,718 | (5,235 | ) | ||||||

Interest (income) expense, net | (420) | 21 | (1,124) | 190 | ||||||||

Depreciation and amortization | 1,748 | 1,535 | 4,913 | 4,219 | ||||||||

Stock-based compensation | 2,707 | 855 | 8,309 | 2,881 | ||||||||

Non-controlling interests | - | 2 | - | 8 | ||||||||

Adjusted EBITDA - Consolidated | $ | 16,214 | $ | 13,858 | $ | 42,164 | $ | 20,427 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

DDS Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Net income attributable to DDS Segment | $ | 8,458 | $ | 16,526 | $ | 23,464 | $ | 16,492 | ||||

Provision for income taxes | 3,868 | (5,887 | ) | 6,667 | (5,183 | ) | ||||||

Interest (income) expense, net | (420) | 20 | (1,125) | 187 | ||||||||

Depreciation and amortization | 819 | 670 | 2,282 | 1,513 | ||||||||

Stock-based compensation | 2,500 | 760 | 7,694 | 2,523 | ||||||||

Non-controlling interests | - | 2 | - | 8 | ||||||||

Adjusted EBITDA - DDS Segment | $ | 15,225 | $ | 12,091 | $ | 38,982 | $ | 15,540 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Synodex Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Net income (loss) attributable to Synodex Segment | $ | (44) | $ | 381 | $ | 529 | $ | 973 | ||||

Depreciation and amortization | 114 | 112 | 289 | 406 | ||||||||

Stock-based compensation | 65 | 38 | 194 | 136 | ||||||||

Adjusted EBITDA - Synodex Segment | $ | 135 | $ | 531 | $ | 1,012 | $ | 1,515 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Agility Segment | 2025 | 2024 | 2025 | 2024 | ||||||||

Net income (loss) attributable to Agility Segment | $ | (72) | $ | 482 | $ | (645) | $ | 899 | ||||

Provision for income taxes | (31) | (57 | ) | 51 | (52 | ) | ||||||

Interest expense | - | 1 | 1 | 3 | ||||||||

Depreciation and amortization | 815 | 753 | 2,342 | 2,300 | ||||||||

Stock-based compensation | 142 | 57 | 421 | 222 | ||||||||

Adjusted EBITDA - Agility Segment | $ | 854 | $ | 1,236 | $ | 2,170 | $ | 3,372 | ||||

INNODATA INC. AND SUBSIDIARIES

CONSOLIDATED REVENUE BY SEGMENT

(Unaudited)

(In thousands)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||

Revenues: | |||||||||||

DDS | $ | 54,779 | $ | 44,694 | $ | 156,186 | $ | 89,810 | |||

Synodex | 1,653 | 1,935 | 5,731 | 5,792 | |||||||

Agility | 6,118 | 5,595 | 17,370 | 15,679 | |||||||

Total Consolidated | $ | 62,550 | $ | 52,224 | $ | 179,287 | $ | 111,281 | |||

SOURCE: Innodata Inc.

View the original press release on ACCESS Newswire

L.Mason--AMWN