-

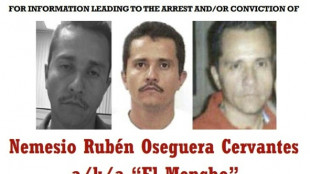

Nemesio Oseguera, the brutal Mexican drug lord known as 'El Mencho'

Nemesio Oseguera, the brutal Mexican drug lord known as 'El Mencho'

-

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

-

New York orders citywide travel ban as major storm hits US

New York orders citywide travel ban as major storm hits US

-

'Considered a traitor': Life of an anti-war Ukrainian in Russia

-

South Korea and Brazil sign deals on K-beauty, trade

South Korea and Brazil sign deals on K-beauty, trade

-

Zimbabwe farmers seek US help over long-promised payouts

-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

-

AGTech to Help Build One-Stop Trading Services Platform as Hong Kong Gold Exchange Opens for the Year of the Horse

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

-

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

I-ON Digital Corp. Deploys $200 Million in Assets Under Management (AUM), Backed By In Situ Gold Reserves, As I-ON's Treasury Solidifies Diversified Yield Strategies From Digital Asset Deployment

Resulting ION.au assets will be deployed into large-scale tokenization and stablecoin programs across I-ON's expanding open-finance network, underscoring accelerating institutional demand for its regulated, gold-backed digital asset platform.

CHICAGO, ILLINOIS / ACCESS Newswire / December 4, 2025 / I-ON Digital Corp. (OTCQB:IONI), a leading U.S. real-world-asset (RWA) infrastructure company specializing in regulated digital asset banking, tokenization, and gold-backed instruments, today announced it has secured multiple asset-deployment commitments totaling more than $200 million in in-situ gold reserves. These commitments advance I-ON's tokenization, treasury management, and advanced liquidity-deployment strategies across its expanding RWA-based ecosystem.

This substantial inflow-aggregated through a growing network of institutional reserve holders - will be digitized and managed through I-ON's regulated Treasury and Digital Asset Platform (DAP), then deployed across the Company's expanding liquidity network. This includes RAAC.io (Regnum Aurum Acquisition Corp.) and GoldfishGold.com, two rapidly scaling distribution gateways for RWAs, gold-backed digital assets, asset-collateralized stablecoins, and Open-Finance lending instruments. Together, these channels create a scalable pipeline for converting in-situ gold reserves into compliant, yield-generating digital financial products.

A MAJOR MILESTONE FOR REGULATED GOLD-BACKED DIGITAL ASSETS

The onboarding of $200 million in ION.au gold-backed digital asset deployment agreements - including both closely held ION.au and ION.au under management - represents one of the largest single tranches of in-situ gold commitments to enter a U.S.-regulated tokenization framework in 2025, positioning I-ON at the forefront of institutional-grade digital asset conversion.

The operational deployments are expected to transform, through material balance sheet and AUM growth, I-ON's suite of digitized financial instruments - including gold-backed tokens, stable-value structures, treasury-grade securities, and liquidity-pool assets - while remaining I-ON's legacy of deploying fully auditable, verifiable, and compliant digital assets within the Company's regulated digital banking architecture.

"This is a watershed moment not only for I-ON, but for the broader RWA tokenization market," said Carlos X. Montoya, Chairman & CEO of I-ON Digital. "The addition of $200 million in tokenized gold - driven by real institutional demand - validates the trust being placed in our model, our compliance infrastructure, and our partner ecosystem. It solidifies I-ON as one of the most credible and scaled gold-digitization platforms in the U.S."

POWERED BY A GROWING LIQUIDITY AND DISTRIBUTION ECOSYSTEM

Through RAAC.io, ION.au becomes programmable collateral that can be deployed across multiple products and venues, including:

- Instant settlement and collateralization in trading, lending, and payments

- Real-time proof-of-reserve visibility and 24/7 auditability

- Liquidity pools and hedged index baskets

- Tokenized capital markets products and yield-structured vehicles

Through GoldfishGold.com, ION.au reaches retail and institutional buyers via:

- Tokenized gold at market-leading spreads

- Integrated buy/sell networks

- Multi-asset vaulting and redemption programs

- Consumer-facing trading routes for I-ON-backed digital gold instruments

Together, these distribution points materially expand market access for I-ON's digitized gold products, enabling efficient deployment into trading markets, structured pools, and alternative liquidity channels.

ACCELERATING TOWARD NATIONAL EXCHANGE UPLISTING TARGETS

As recently announced, in conjunction with a I-ON Digital - Craft Capital Management NASDAQ up-listing engagement, this multi-faceted asset deployment arrives as I-ON continues to strengthen its capital markets readiness ahead of its planned 2026 national exchange uplisting, supported by recent:

- Digital asset banking advancements

- New tokenization partnerships

- Strategic engagements with capital advisors

- Expanded RWA infrastructure and institutional onboarding

"The momentum across our ecosystem is unmistakable," said Ken Park, Director & Chief Marketing Officer of I-ON Digital. "Our partners at RAAC.io and GoldfishGold.com continue to amplify market reach and accelerate capital inflows. This milestone reinforces the growing institutional appetite for regulated, high-integrity tokenized gold-and the unique position I-ON holds in delivering it."

ABOUT I-ON DIGITAL CORP.

I-ON Digital Corp. (OTCQB:IONI) is a U.S.-based digital asset infrastructure company focused on real-world-asset (RWA) tokenization, regulated gold-backed digital instruments, and digital asset banking services. I-ON's platform enables institutions to securely digitize, tokenize, manage, and distribute physical and in-situ assets through compliant, treasury-grade digital frameworks. The Company's extended ecosystem includes partnerships with RAAC.io, Instruxi Limited, Chainlink Labs, and other global RWA technology leaders. To learn more, visit https://iondigitalcorp.com

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

I-ON Digital Corp.

[email protected]

(866) 440-2278

https://iondigitalcorp.com

FORWARD-LOOKING STATEMENTS

Statements contained in this press release regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company's capital markets activities, growth expectations, industry trends, potential uplisting, and future operational initiatives. These statements are based on current assumptions and are subject to risks and uncertainties that may cause actual results to differ materially. Factors that may cause such differences include, but are not limited to, regulatory developments, market adoption of digital asset products, capital market conditions, operational risks, and those described in the Company's filings with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements except as required by law.

SOURCE: I-ON Digital Corp

View the original press release on ACCESS Newswire

Ch.Havering--AMWN