-

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

-

New York orders citywide travel ban as major storm hits US

-

'Considered a traitor': Life of an anti-war Ukrainian in Russia

'Considered a traitor': Life of an anti-war Ukrainian in Russia

-

South Korea and Brazil sign deals on K-beauty, trade

-

Zimbabwe farmers seek US help over long-promised payouts

Zimbabwe farmers seek US help over long-promised payouts

-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

Hong Kong appeals court to rule on jailed democracy campaigners

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

-

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

-

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

-

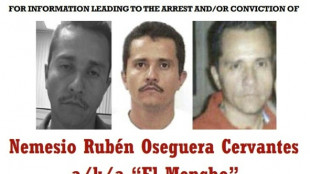

Top Mexican drug cartel leader killed

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Greenlane Buys $8 Million worth of BERA, Maintains Approximately $32 Million Cash and Stablecoin Reserves for Berachain Treasury Strategy

BOCA RATON, FL / ACCESS Newswire / December 8, 2025 / Greenlane Holdings, Inc. ("Greenlane" or the "Company") (Nasdaq:GNLN), a Berachain-focused digital asset treasury company and global seller of premium cannabis accessories, and subsequent to the Company's press releases issued on October 24, 2025 and November 14, 2025 that disclosed Greenlane's Berachain cryptocurrency treasury strategy (the "Berachain Treasury Strategy"), is providing an update on its BERA token holdings, staking activity, and capital position related to its participation in the Berachain ecosystem.

The Company commenced its Berachain Treasury Strategy on October 23, 2025. Between October 23 and December 3, 2025, Greenlane purchased $8 million of BERA, expanding its BERA holdings by approximately 5.76 million BERA at an average purchase price of approximately $1.39 per BERA.

The Company has staked substantially all of approximately 8.33 million BERA, representing the liquid on-chain portion of its 60.17 million BERA position1. The remainder of the BERA tokens remain subject to lock up or vesting. As of December 8, 2025, Greenlane has earned over 180,000 BERAfrom staking since launching the Berachain Treasury Strategy. The annualized percentage return of Berachain's Proof of Liquidity ("PoL") staking on December 3, 2025 was 30%2, subject to prevailing network conditions3.

As of December 3, 2025, the Company had approximately 32 million dollars of U.S. dollar cash and dollar pegged stablecoin reserves allocated to the Berachain Treasury Strategy4. Purely for illustrative purposes, if BERA tokens were available at $1.00 per token and assuming no impact from the Company's own purchases on market prices, that cash would equate to approximately 31 million BERA, or roughly 23% of the estimated circulating supply as of December 3, 2025, based on data from CoinMarketCap. There is no assurance that such tokens would be available at those prices or in those quantities.

"I believe that we have maintained a disciplined investment approach throughout a volatile cryptocurrency market. We retain the vast majority of the net proceeds from our recent private investment, which puts us in a strong position to continue building out our BERA treasury and yield generation strategies over the remainder of 2025 and into 2026," said Ben Isenberg, Chief Investment Officer.

Greenlane expects to continue purchasing BERA during the fourth quarter of 2025, with plans to deploy into PoL staking and/or decentralized finance venues across the Berachain ecosystem to generate additional revenues.

About Greenlane

Greenlane is a global platform for the development and distribution of premium smoking accessories, vape devices, and lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers. In October 2025, Greenlane initiated a Berachain treasury strategy dedicated to acquiring BERA and increasing BERA-per-share through active management of the Company's treasury. The Company is a Berachain ecosystem participant focused on supporting the development and operation of blockchain-based infrastructure, including assets and applications built on Berachain. The Company engages in network staking, liquidity provisioning, and strategic initiatives intended to contribute to the long-term sustainability of decentralized protocols within its portfolio.

About Berachain

Berachain (BERA) is the first blockchain powered by Proof of Liquidity, designed to help businesses scale and provide sustainable on-chain economies. Proof of Liquidity provides BERA with a staking yield derived from the revenues or ownership of profitable, revenue-generating companies building on the network. Berachain has raised $150M from leading digital asset investors including Brevan Howard, Framework Ventures, Polychain Capital, Samsung Next, Laser Digital by Nomura, Goldentree Asset Management, SBI VC Trade and more.

Media Contacts:

Greenlane Holdings, Inc.

Investor Contact:

[email protected]

or

PCG Advisory

Kevin McGrath

+1-646-418-7002

Forward-Looking Statements

This press release contains statements that constitute "forward-looking statements." Forward-looking statements are statements other than historical facts and include, without limitation, statements regarding progress and achievement of the Company's goals regarding BERA acquisition and staking, the long-term value of BERA, continued growth and advancement of the Company's Berachain Treasury Strategy and the applicable benefits to the Company, and other projections or statements of plans and objectives.

These forward-looking statements are based on current expectations, estimates, assumptions, and projections, and involve known and unknown risks, uncertainties, and other factors, many of which are beyond the Company's control, that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such statements. Important factors that may affect actual results include, among others, the Company's ability to execute its growth strategy; its ability to raise and deploy capital effectively; developments in technology and the competitive landscape; changes in the regulatory landscape applicable to digital assets, including BERA; the market performance of BERA; and other risks and uncertainties described under "Risk Factors" in the Company's Annual Report on Form 10-K filed with the SEC on March 21, 2025, Quarterly Report on Form 10-Q for the quarter ended September 30, 2025 filed with the SEC on November 14, 2025 and in other subsequent filings with the SEC. These filings are available at www.sec.gov. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Cautionary Note Regarding Digital Assets

BERA is a digital asset that is not legal tender, is not backed by any government or central bank and may be subject to extreme price volatility, regulatory uncertainty and technological risk. Investments in and exposures to digital assets such as BERA are highly speculative and may result in the loss of all or a substantial portion of the invested capital. The Company's activities involving BERA and other digital assets may not be suitable for all investors and are subject to the risks described in the "Risk Factors" in the Company's Annual Report on Form 10-K filed with the SEC on March 21, 2025, Quarterly Report on Form 10-Q for the quarter ended September 30, 2025 filed with the SEC on November 14, 2025 and in other subsequent filings with the SEC. These filings are available at www.sec.gov.

1 Current 60.17 million BERA holding is comprised of (i) initial BERA holding of 54.23 million BERA, per Greenlane press release dated October 24, 2025, (ii) 5.76 million BERA purchased, and (iii) 0.18 million BERA earned from staking.

2 Annualized protocol rate calculated using weekly data, "return" refers to protocol rewards measured in BERA units (i.e. a 30% annualized return on 100 BERA is 30 BERA). A quoted rate of return is a point-in-time protocol figure. Reward and return metrics can fluctuate rapidly, and should not be viewed as indicative of future results or as any guarantee of future performance. The current and historical annualized rates of return may be viewed at any point on https://hub.berachain.com/stake/

3 Prevailing network conditions include, but may not be limited to, protocol parameter changes, reward schedule adjustments, validator set changes and market volatility.

4 Per Greenlane press release dated October 24, 2025, the Company raised gross proceeds of $50 million in closed Private Investment in Public Entity Financing, or 43 million dollars in U.S. dollar cash and dollar-pegged stablecoins, net of transaction fees. Less approximately $3 million in cash used by the Company's legacy business and approximately $8 million used to purchase BERA between October 23 and December 3, 2025, leaving approximately 32 million dollars of U.S. dollar cash and dollar-pegged stablecoins remaining, allocated to the Berachain Treasury Strategy.

SOURCE: Greenlane Holdings, Inc.

View the original press release on ACCESS Newswire

L.Miller--AMWN