-

Trump has options on Iran, but first must define goal

Trump has options on Iran, but first must define goal

-

Paris FC's Ikone stuns PSG to knock out former club from French Cup

-

Australia's ambassador to US leaving post, marked by Trump rift

Australia's ambassador to US leaving post, marked by Trump rift

-

Slot angered by 'weird' Szoboszlai error in Liverpool FA Cup win

-

Szoboszlai plays hero and villain in Liverpool's FA Cup win

Szoboszlai plays hero and villain in Liverpool's FA Cup win

-

Hawaii's Kilauea volcano puts on spectacular lava display

-

US stocks at records despite early losses on Fed independence angst

US stocks at records despite early losses on Fed independence angst

-

Koepka rejoins PGA Tour under new rules for LIV players

-

Ex-France, Liverpool defender Sakho announces retirement

Ex-France, Liverpool defender Sakho announces retirement

-

Jerome Powell: The careful Fed chair standing firm against Trump

-

France scrum-half Le Garrec likely to miss start of Six Nations

France scrum-half Le Garrec likely to miss start of Six Nations

-

AI helps fuel new era of medical self-testing

-

Leaders of Japan and South Korea meet as China flexes muscles

Leaders of Japan and South Korea meet as China flexes muscles

-

Trump sets meeting with Venezuelan opposition leader, Caracas under pressure

-

Australia captain Alyssa Healy to retire from cricket

Australia captain Alyssa Healy to retire from cricket

-

US 'screwed' if Supreme Court rules against tariffs: Trump

-

NATO, Greenland vow to boost Arctic security after Trump threats

NATO, Greenland vow to boost Arctic security after Trump threats

-

Israel to take part in first Eurovision semi-final on May 12

-

How Alonso's dream Real Madrid return crumbled so quickly

How Alonso's dream Real Madrid return crumbled so quickly

-

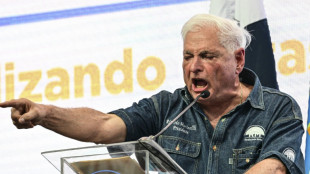

Former Panama leader on trial over mega Latin America corruption scandal

-

Trump keeping Iran air strikes on the table: White House

Trump keeping Iran air strikes on the table: White House

-

Paramount sues in hostile bid to buy Warner Bros Discover

-

Ugandan opposition leader Bobi Wine warns of protests if polls rigged

Ugandan opposition leader Bobi Wine warns of protests if polls rigged

-

Airbus delivers more planes in 2025

-

Alonso leaves Real Madrid, Arbeloa appointed as coach

Alonso leaves Real Madrid, Arbeloa appointed as coach

-

UK pays 'substantial' compensation to Guantanamo inmate: lawyer

-

Iran protest toll mounts as government stages mass rallies

Iran protest toll mounts as government stages mass rallies

-

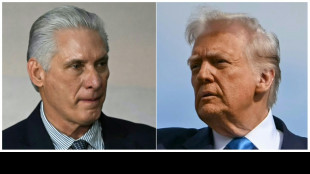

Cuba denies being in talks with Trump on potential deal

-

Scientists reveal what drives homosexual behaviour in primates

Scientists reveal what drives homosexual behaviour in primates

-

Venezuela releases more political prisoners as pressure builds

-

15,000 NY nurses stage largest-ever strike over conditions

15,000 NY nurses stage largest-ever strike over conditions

-

Rosenior plots long Chelsea stay as Arsenal loom

-

Zuckerberg names banker, ex-Trump advisor as Meta president

Zuckerberg names banker, ex-Trump advisor as Meta president

-

Reza Pahlavi: Iran's ex-crown prince dreaming of homecoming

-

Venezuela releases more political prisoners

Venezuela releases more political prisoners

-

Kenya's NY marathon champ Albert Korir gets drug suspension

-

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

-

Russian captain in fiery North Sea crash faces UK trial

-

Carrick is frontrunner for interim Man Utd job: reports

Carrick is frontrunner for interim Man Utd job: reports

-

Iran government stages mass rallies as alarm grows over protest toll

-

Variawa leads South African charge over Dakar dunes

Variawa leads South African charge over Dakar dunes

-

Swiss inferno bar owner detained for three months

-

Heathrow airport sees record high annual passenger numbers

Heathrow airport sees record high annual passenger numbers

-

Georgia jails ex-PM for five years amid ruling party oustings

-

Kyiv buries medic killed in Russian drone strike

Kyiv buries medic killed in Russian drone strike

-

Israel revokes French researcher's travel permit

-

India and Germany seek to boost defence industry ties

India and Germany seek to boost defence industry ties

-

French coach and football pundit Rolland Courbis dies at 72

-

UK regulator opens probe into X over sexualised AI imagery

UK regulator opens probe into X over sexualised AI imagery

-

AFCON organisers investigate incidents after Algeria-Nigeria clash

Ondas Holdings Inc. Announces Closing of $1 Billion Offering

WEST PALM BEACH, FLORIDA / ACCESS Newswire / January 12, 2026 / Ondas Holdings Inc. (NASDAQ:ONDS) ("Ondas" or the "Company"), a leading provider of autonomous aerial and ground robot intelligence through its Ondas Autonomous Systems (OAS) business unit and private wireless solutions through Ondas Networks, announced today the closing of its registered direct offering of 19,000,000 shares of its common stock and, in lieu of common stock, pre-funded warrants to purchase up to 41,790,274 shares of its common stock (together "Common Stock Equivalents") to an institutional investor. Each Common Stock Equivalent was sold with a common stock warrant to purchase two (2) shares of common stock. The total number of Common Stock Equivalents sold in the offering was 60,790,274. The Common Stock Equivalents are accompanied by warrants to purchase a total of 121,580,548 shares of common stock, which we refer to as common stock warrants. Ondas estimates net proceeds from the offering to be approximately $959.2 million, after deducting placement agent fees and estimated offering expenses. If the common stock warrants are fully exercised on a cash basis, Ondas has the potential to raise approximately $3.4 billion in additional gross proceeds. No assurance can be given that any of the common stock warrants will be exercised.

Each share of common stock and accompanying common stock warrant was sold together at a combined offering price of $16.45, and each pre-funded warrant and accompanying common stock warrant was sold together at a combined offering price of $16.4499 (with a nominal exercise price of $0.0001 per share remaining unpaid as of the issuance date), each priced above-the-market under the rules of the Nasdaq Stock Market and representing a premium of approximately 17.5% to Ondas' closing stock price on January 8, 2026. Each pre-funded warrant is exercisable immediately after the original issue date and will expire seven years from the date of issuance. Each common stock warrant has an exercise price of $28.00 per share, is immediately exercisable and will expire seven years from the date of issuance. All of the shares, pre-funded warrants and common stock warrants in the offering were sold by the Company.

Ondas intends to use the net proceeds from this offering for corporate development and strategic growth, including acquisitions, joint ventures, and investments.

Oppenheimer & Co. Inc. acted as the lead placement agent for the offering. Stifel, Nicolaus & Company, Incorporated, Needham & Company, LLC, Lake Street Capital Markets, LLC, Northland Capital Markets, Ladenburg Thalmann & Co. Inc., H.C. Wainwright & Co., LLC, and Maxim Group LLC acted as co-placement agents for the offering.

Akerman LLP served as legal counsel to Ondas and Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. served as legal counsel to the placement agents.

An automatic shelf registration statement on Form S-3ASR (File No. 333-290121) relating to the securities issued in the offering was filed with the Securities and Exchange Commission ("SEC") and was automatically effective upon filing on September 9, 2025. A final prospectus supplement and accompanying prospectus describing the terms of the offering has been filed with the SEC. Copies of the final prospectus supplement and the accompanying prospectus relating to the securities offered may also be obtained from Oppenheimer & Co. Inc. Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8055, or by email at [email protected]. Electronic copies of the final prospectus supplement and accompanying prospectus are also available on the SEC's website at http://www.sec.gov.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, these securities, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the intended use of net proceeds from the offering. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties relate, among other things, to fluctuations in our stock price and changes in market conditions. Our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading "Risk Factors" discussed under the caption "Item 1A. Risk Factors" in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption "Item 1A. Risk Factors" in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc.

888.350.9994

[email protected]

Media Contact for Ondas

Escalate PR

[email protected]

Preston Grimes

Marketing Manager, Ondas Holdings Inc.

[email protected]

SOURCE: Ondas Holdings Inc.

View the original press release on ACCESS Newswire

B.Finley--AMWN