-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

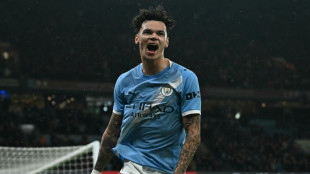

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

Swiatek fights back to reach Qatar Open quarter-finals

-

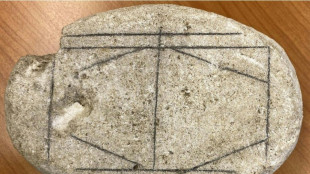

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

New drones provide first-person thrill to Olympic coverage

-

Instagram CEO to testify at social media addiction trial

-

Deadly mass shooting in Canada: What we know

Deadly mass shooting in Canada: What we know

-

NATO launches 'Arctic Sentry' mission after Greenland crisis

-

Israel's Netanyahu at White House to push Trump on Iran

Israel's Netanyahu at White House to push Trump on Iran

-

Canada stunned by deadliest school shooting in decades

Sokoman Minerals Corp. Closes First Tranche of Non-Brokered Flow-Through and Hard-Dollar Private Placement Financing

Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF)("Sokoman" or the "Company") is pleased to announce that further to its December 4, 2024 news release, the Company has received conditional approval from the TSX Venture Exchange (the "Exchange") for its non-brokered flow-through and hard-dollar financing (the "Financing") and will be closing the first tranche of the Financing for aggregate gross proceeds of CAD$1,421,250.

The Company will now issue 35,400,000 CAD$0.04 flow-through shares, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada).

The Company is also issuing 150,000 CAD$0.035 non-flow-through common shares.

In connection with the Financings, the Company is paying cash finders' fees totaling CAD$42,000, issuing 1,050,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year. And issuing 1,200,000 common shares to two finders, as permitted by the policies of the Exchange.

All securities issued pursuant to the Financing are subject to a four-month and one-day hold period.

Final approval of the Financing is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: [email protected]

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: [email protected]

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

H.E.Young--AMWN