-

Meillard crowns Swiss men's Olympic domination with slalom gold

Meillard crowns Swiss men's Olympic domination with slalom gold

-

German carnival revellers take swipes at Putin, Trump, Epstein

-

England survive Italy scare to reach T20 World Cup Super Eights

England survive Italy scare to reach T20 World Cup Super Eights

-

Gold rush grips South African township

-

'Tehran' TV series producer Dana Eden found dead in Athens

'Tehran' TV series producer Dana Eden found dead in Athens

-

Iran FM in Geneva for US talks, as Guards begin drills in Hormuz Strait

-

AI chatbots to face UK safety rules after outcry over Grok

AI chatbots to face UK safety rules after outcry over Grok

-

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

-

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

-

Spain unveils public investment fund to tackle housing crisis

-

African diaspora's plural identities on screen in Berlin

African diaspora's plural identities on screen in Berlin

-

Del Toro wins shortened UAE Tour first stage

-

German carnival revellers take sidesweep at Putin, Trump, Epstein

German carnival revellers take sidesweep at Putin, Trump, Epstein

-

Killing of far-right activist stokes tensions in France

-

Record Jacks fifty carries England to 202-7 in must-win Italy match

Record Jacks fifty carries England to 202-7 in must-win Italy match

-

European stocks, dollar up in subdued start to week

-

African players in Europe: Salah hailed after Liverpool FA Cup win

African players in Europe: Salah hailed after Liverpool FA Cup win

-

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

-

Kyrgyzstan president fires ministers, consolidates power ahead of election

Kyrgyzstan president fires ministers, consolidates power ahead of election

-

McGrath tops Olympic slalom times but Braathen out

-

Greenland's west coast posts warmest January on record

Greenland's west coast posts warmest January on record

-

South Africa into Super Eights without playing as Afghanistan beat UAE

-

Madagascar cyclone death toll rises to 59

Madagascar cyclone death toll rises to 59

-

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

Job threats, rogue bots: five hot issues in AI

-

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

APOZ Project of TKCM is Nominated for the Pinnacle Award

-

CAVU Resources, Inc. Updates Corporate Website to Reflect Long-Term Direction and Ownership Mindset

CAVU Resources, Inc. Updates Corporate Website to Reflect Long-Term Direction and Ownership Mindset

-

GREATER THAN Redefines Hydration for Women With New 12oz Cans, Retail Expansion and GoddessLand(TM)

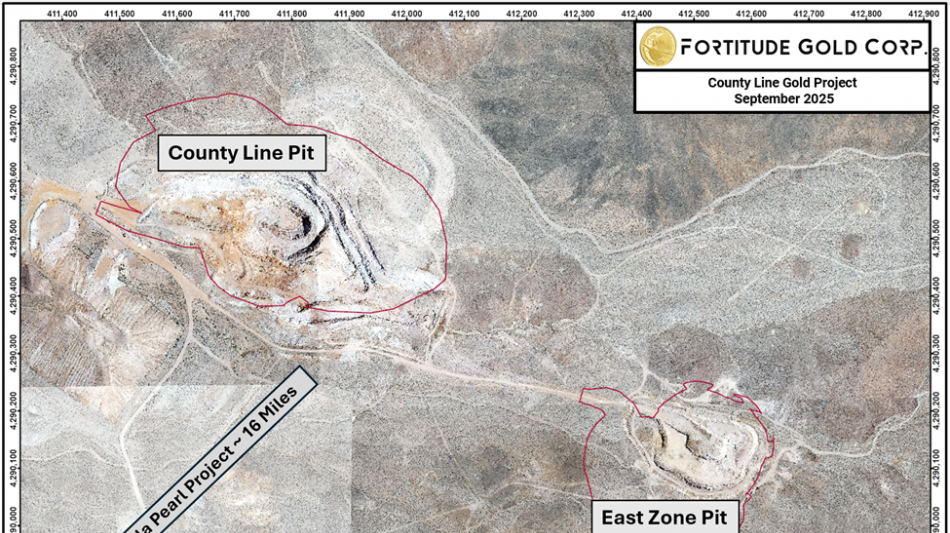

Fortitude Gold Receives Bureau of Land Management EA Permit for County Line Mine

COLORADO SPRINGS, CO / ACCESS Newswire / September 8, 2025 / Fortitude Gold Corp. (OTCQB:FTCO) (the "Company") today announced it has been granted approval by the Bureau of Land Management ("BLM") to construct and operate the County Line Mine gold project located in both Mineral and Nye Counties, Nevada. Fortitude Gold is a gold producer, developer, and explorer with operations in Nevada, U.S.A. offering investors exposure to both gold production and dividend yield.

County Line's Environmental Assessment permit and the Plan of Operation ("POO") for the Project have been approved by the BLM. Remaining approvals include a BLM Bond Determination letter for reclamation costs and a Nevada Reclamation Permit from the Department of Environmental Protection ("NDEP") for surface disturbance approval. Both remaining approvals are expected in the near future.

COUNTY LINE HIGHLIGHTS

Open pit gold project

High-grade oxide Au ~1g/t

Proximity to Isabella Pearl processing facilities

Short haul distance for mineralization

Minimal infrastructure required to construct mine

Minimal CAPEX required to production

Minimal timeframe required to production

Second permitted ore source for Company operations

The County Line Project is located approximately 16 miles northeast of the Company's operating Isabella Pearl gold mine via Nevada State Route 361. The project is located within both Mineral and Nye Counties, Nevada and straddles the borders between the two. The project has a minimal footprint impact and limited required infrastructure whereby the Company intends to mine and truck County Line mineralization to its nearby Isabella Pearl operation, leveraging the Company's existing heap leach pad and gold processing facilities. The project includes the expansion of two existing historic open pits and an existing waste rock storage facility, low- and high-grade ore stockpiles, access roads, a mobile crushing facility, and exploration drilling within the proposed POO boundary for potential project expansion.

The Company is currently mining its Isabella Pearl deposit targeting the Pearl deep mineralization. Once all County Line permit approvals are in place, the Company plans to begin the initial infrastructure work for the County Line project, primarily road construction and water infrastructure, in preparation for near-term mine operations. A best estimate at this time suggests by mid-2026 Pearl Deep will be completed, freeing up mine equipment to ramp up County Line operations.

The Company targets an annualized run rate of approximately 20,000 gold ounces from County Line over two years, with expansion potential from drilled mineralization not included in the resource and untested drill targets. The 2022 Mineral Resource focused exclusively on the historic County Line pit. Subsequent drilling at County Line in 2023 and 2024 focused on the property's historic East pit. Mineralization defined at the East pit is not included in the 2022 Mineral Resource (noted below) and has the potential to further extend the mine life of the project.

"After years of unfortunate permit delays from the previous federal administration, we are excited to finally receive federal permit approval from the BLM for our County Line project," stated Mr. Jason Reid, CEO and President of Fortitude Gold. "The project's proximity to our Isabella Pearl's processing facilities should allow us to leverage our operations and place County Line into production faster and cheaper that most all other new mine builds. We are also actively pursuing permits for Scarlet South, about 500 meters from Isabella Pearl, as an open pit adding to our hub and spoke approach to mine building and additional mineralized feed for our operations."

Mr. Reid Continued, "We remain pleased and excited to see the mine permit backlog continue to clear up under this new federal Trump Administration. We look forward to receiving the remaining ancillary approvals for County Line and we are excited to build our second mine. The Company will continue to push for as many permits as possible under the Trump Administration to add to production longevity and exploration optionality."

County Line, Mineral & Nye Counties, Nevada, USA - Summary of Gold Mineral Resources at End of the Fiscal Year ended December 31, 2022 1 2 3 4 5 6 7 8 9

Classification | Tonnes | Au (g/t) | Au (oz) |

Measured (M) | 579,500 | 1.04 | 19,500 |

Indicated (I) | 623,000 | 0.90 | 17,900 |

M+I | 1,202,500 | 0.97 | 37,400 |

Inferred | 438,000 | 0.87 | 12,200 |

Reported at a cutoff grade of 0.33 g/t Au.

Cutoff grade calculations used mining, processing, energy, administrative and smelting/refining costs based on 2022 actual costs for the Company's producing Isabella Pearl mine.

Metallurgical gold recovery assumption used was 81%. This recovery reflects the predicted average recovery from metallurgical test programs at the Isabella Pearl mine.

Whole block diluted estimates are reported within an optimized pit shell

Mineral Resources do not have demonstrated economic viability

Totals may not sum exactly due to rounding

"g/t" = gram/metric tonne

"oz" = Troy ounce

Gold price $1,750 per oz assumed. The gold price as reported on December 31, 2022 was $1,812 per oz.

About Fortitude Gold Corp.:

Fortitude Gold is a U.S. based gold producer targeting projects with low operating costs, high margins, and strong returns on capital. The Company's strategy is to grow organically, remain debt-free, and distribute dividends. The Company's Nevada Mining Unit consists of seven high-grade gold properties located in the Walker Lane Mineral Belt and an eighth high-grade gold property in west central Nevada. The Isabella Pearl gold mine, located on the Isabella Pearl mineralized trend, is currently in production and County Line is our next targeted mine build. Nevada, U.S.A. is among the world's premier mining friendly jurisdictions.

Cautionary Statements: This press release contains forward-looking statements that involve risks and uncertainties. If you are risk-averse you should NOT buy shares in Fortitude Gold Corp. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. When used in this press release, the words "plan", "target", "anticipate," "believe," "estimate," "intend" and "expect" and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding the Company's strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material are forward-looking statements. All forward-looking statements in this press release are based upon information available to the Company on the date of this press release, and the Company assumes no obligation to update any such forward-looking statements. Forward looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company's actual results could differ materially from those discussed in this press release.

Contact:

Greg Patterson

719-717-9825

[email protected]

www.Fortitudegold.com

SOURCE: Fortitude Gold Corp

View the original press release on ACCESS Newswire

M.Thompson--AMWN