-

European stocks sink, gold hits high on escalating tariff fears

European stocks sink, gold hits high on escalating tariff fears

-

EU vows 'unflinching' response to Trump's Greenland gambit

-

Osaka steals show at Australian Open as Sinner strolls through

Osaka steals show at Australian Open as Sinner strolls through

-

Brignone impresses in first run of Kronplatz giant slalom in World Cup comeback

-

Osaka emerges for Melbourne opener under white hat and umbrella

Osaka emerges for Melbourne opener under white hat and umbrella

-

Malawi suffers as US aid cuts cripple healthcare

-

Bessent says Europe dumping US debt over Greenland would 'defy logic'

Bessent says Europe dumping US debt over Greenland would 'defy logic'

-

Freeze, please! China's winter swimmers take the plunge

-

Talks between Damascus, Kurdish-led forces 'collapse': Kurdish official to AFP

Talks between Damascus, Kurdish-led forces 'collapse': Kurdish official to AFP

-

In-form Bencic makes light work of Boulter at Australian Open

-

Sinner into Melbourne round two as opponent retires hurt

Sinner into Melbourne round two as opponent retires hurt

-

Israel begins demolitions at UNRWA headquarters in east Jerusalem

-

Almost half of Kyiv without heat, power, after Russian attack: govt

Almost half of Kyiv without heat, power, after Russian attack: govt

-

Veteran Monfils exits to standing ovation on Australian Open farewell

-

Precision-serving former finalist Rybakina powers on in Melbourne

Precision-serving former finalist Rybakina powers on in Melbourne

-

South Korea's women footballers threaten boycott over conditions

-

Australian lawmakers back stricter gun, hate crime laws

Australian lawmakers back stricter gun, hate crime laws

-

EU wants to keep Chinese suppliers out of critical infrastructure

-

AI reshaping the battle over the narrative of Maduro's US capture

AI reshaping the battle over the narrative of Maduro's US capture

-

Penguins bring forward breeding season as Antarctica warms: study

-

Ukrainian makes soldier dad's 'dream come true' at Australian Open

Ukrainian makes soldier dad's 'dream come true' at Australian Open

-

'Timid' Keys makes shaky start to Australian Open title defence

-

Indiana crowned college champions to complete fairytale season

Indiana crowned college champions to complete fairytale season

-

South Koreans go cuckoo for 'Dubai-style' cookies

-

Harris leads Pistons past Celtics in thriller; Thunder bounce back

Harris leads Pistons past Celtics in thriller; Thunder bounce back

-

Tjen first Indonesian to win at Australian Open in 28 years

-

Long-delayed decision due on Chinese mega-embassy in London

Long-delayed decision due on Chinese mega-embassy in London

-

Djokovic jokes that he wants slice of Alcaraz's winnings

-

Trump tariff threat 'poison' for Germany's fragile recovery

Trump tariff threat 'poison' for Germany's fragile recovery

-

Tourists hit record in Japan, despite plunge from China

-

Jittery Keys opens Melbourne defence as Sinner begins hat-trick quest

Jittery Keys opens Melbourne defence as Sinner begins hat-trick quest

-

The impact of Trump's foreign aid cuts, one year on

-

Belgian court weighs trial for ex-diplomat over Lumumba killing

Belgian court weighs trial for ex-diplomat over Lumumba killing

-

Inside China's buzzing AI scene year after DeepSeek shock

-

Asian markets sink, silver hits record as Greenland fears mount

Asian markets sink, silver hits record as Greenland fears mount

-

Shark bites surfer in Australian state's fourth attack in 48 hours

-

North Korea's Kim sacks vice premier, rails against 'incompetence'

North Korea's Kim sacks vice premier, rails against 'incompetence'

-

Spain mourns as train crash toll rises to 40

-

'Very nervous' Keys makes shaky start to Australian Open title defence

'Very nervous' Keys makes shaky start to Australian Open title defence

-

Vietnam leader promises graft fight as he eyes China-style powers

-

Dad-to-be Ruud ready to walk away from Australian Open

Dad-to-be Ruud ready to walk away from Australian Open

-

North Korea's Kim sacks senior official, slams 'incompetence'

-

Farewells, fresh faces at Men's Fashion Week in Paris

Farewells, fresh faces at Men's Fashion Week in Paris

-

'I do not want to reconcile with my family' says Brooklyn Peltz Beckham

-

EU leaders take stage in Davos as Trump rocks global order

EU leaders take stage in Davos as Trump rocks global order

-

Blast at Chinese restaurant in Kabul kills 7

-

Warner hits 'Sinners' and 'One Battle' tipped for Oscar nominations

Warner hits 'Sinners' and 'One Battle' tipped for Oscar nominations

-

Guatemalans call for iron fist over surge in gang violence

-

Kronos Advanced Technologies, Inc. (OTC: KNOS) Reports Fiscal 2025 Revenue of Controlled Subsidiary Zyppah, Inc

Kronos Advanced Technologies, Inc. (OTC: KNOS) Reports Fiscal 2025 Revenue of Controlled Subsidiary Zyppah, Inc

-

Moderna & Merck Announce 5-Year Data for Intismeran Autogene in Combination With KEYTRUDA(R) (pembrolizumab) Demonstrated Sustained Improvement in the Primary Endpoint of Recurrence-Free Survival in Patients With High-Risk Stage III/IV Melanoma Following Complete Resection

Quarterly Activities Report December 2025

Highlights

Phase 1 construction at Hombre Muerto West (HMW) on track for first production in H1 2026, well timed to take advantage of a lithium market recovery

Strategic expansion of Greenbushes South tenure

Early completion of the second tranche of the Clean Elements leading to a strong financial position with cash of $15 M. (as at 31 December 2025), no debt and an undrawn US$ 6 M. prepayment facility

PERTH, AU / ACCESS Newswire / January 19, 2026 / Galan Lithium Limited ( Galan or the Company ) presents its Quarterly Activities Report for the quarter ended 31 December 2025, along with activities up to the date of this release.

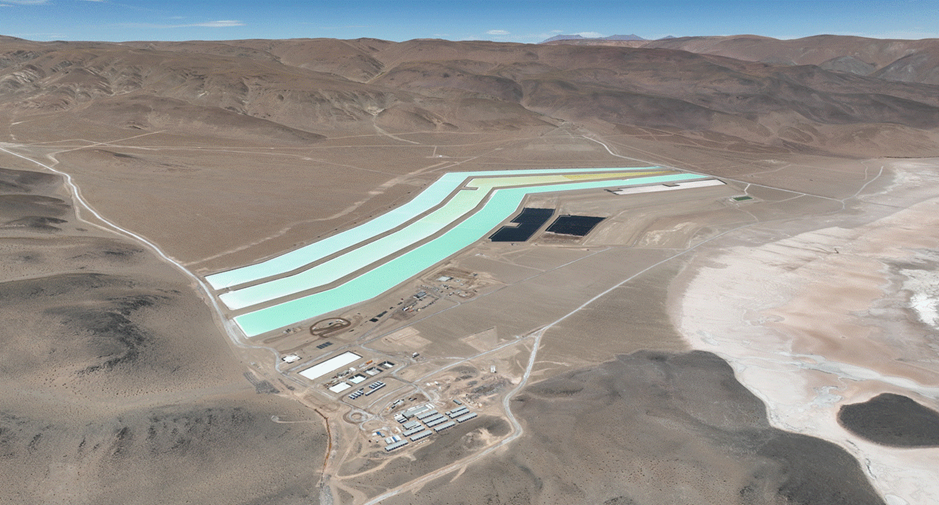

During the quarter, Galan continued to focus on the construction of Phase 1 at its 100% owned HMW lithium brine project in Argentina. Galan delivered a series of material advancements at HMW that firmly position it to transition from developer to producer in H1 2026.

In addition, Galan strategically expanded its footprint in the highly prospective Greenbushes region of Western Australia providing the opportunity to test the geological continuity between the Greenbushes Mine and Galan's tenure at Greenbushes South, 2 kilometres along strike.

Figure 1. HMW site looking north

Speaking on the progress achieved this quarter, Managing Director Juan Pablo ("JP") Vargas de la Vega said:

" This was a strong quarter for Galan, marked by meaningful progress in construction activities at Hombre Muerto West. With construction funding for Phase 1 secured and workstreams well advanced, we remain firmly on track for first production in H1 2026. Importantly, we continue to assess the opportunity to expand Phase 1 capacity from 4,000 tpa LCE to a capacity above 5,000 tpa LCE by leveraging existing infrastructure and improving project scale.

2026 will be a transformative year for Galan and its shareholders, as we move toward production and cash flow at a time of vastly improved sentiment and market conditions for the lithium sector."

Project Execution - Hombre Muerto West

Execution of Phase 1 at HMW advanced materially during the quarter, with construction progressing in line with schedule toward first production in H1 2026.

The Phase 1 nano-filtration plant was assembled and tested in Sydney, confirming performance in accordance with design parameters. Following testing, the plant was containerised and dispatched for shipment to site, with delivery expected in early 2026 and commissioning to follow.

Figure 2. Load out of nano-filtration plant

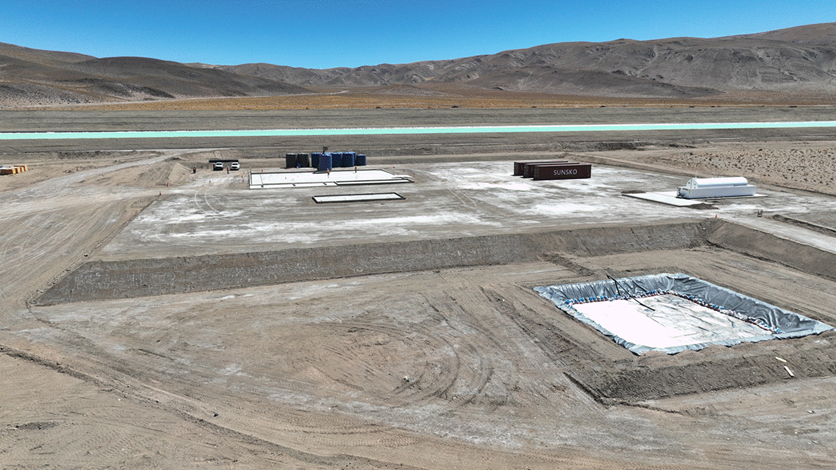

On site, substantial progress was made across evaporation ponds and plant infrastructure. Ponds 4 and 5 were redesigned and constructed to support the 4,000 tpa LCE Phase 1 production rate. Earthworks for the process plant were completed and the concrete foundation slab poured. Engineering and procurement activities remained focused on integrating the nano-filtration facility with the pond system. The majority of long-lead items are now on site or in transit.

Figure 3. Completed earthworks and concrete foundations at HMW plant site

The Company maintained a strong safety and environmental record during the quarter, with no lost time injuries and continued compliance with regulatory approvals and community engagement commitments.

Overall, Phase 1 execution at HMW continues to progress as planned, supported by strong coordination between Galan, its contractors and strategic partners.

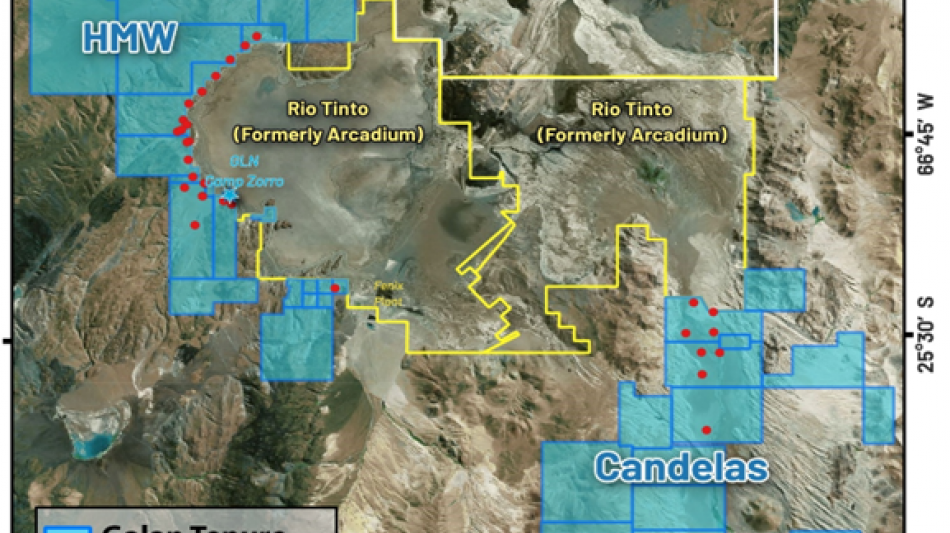

Figure 4: Location of Galan's 100% owned HMW and Candelas Projects in Argentina

Greenbushes South (WA)

Strategic tenure expansion

In October 2025, Galan was granted exploration licence E70/4889 and prospecting licences P70/1702, P70/1703 and P70/1704 by the Western Australian Department of Mines, Industry Regulation and Safety. The new tenure is located approximately two kilometres south of, and along strike from, the Tier 1 Greenbushes lithium mine.

Figure 5. Drone photo showing new tenements relative to the Greenbushes Mine

Importantly, the licences cover the interpreted continuation of the primary mineralising structure associated with Greenbushes, including the Donnybrook-Bridgetown Shear Zone. This significantly enhances Galan's strategic landholding in one of the world's most prospective lithium districts and increases exposure to the structural corridor believed to control pegmatite emplacement.

The licences provide an opportunity to test geological continuity between the Greenbushes system and Galan's existing tenure. Exploration planning is underway, building on previous airborne geophysical surveys, with initial work expected to commence in the second half of FY2026, subject to permitting and conditions. Further details will be provided once programs and budgets are finalised.

Early completion of Clean Elements Placement

In November 2025 Galan announced it had received the second and final A$10 million tranche of the A$20 million placement from the Clean Elements Fund. The accelerated completion of the placement reflected Clean Elements' confidence in HMW and provided the final equity piece required to fund Phase 1 construction.

Completion of the placement followed a significant period of due diligence by the Clean Elements Fund which further validated HMW's world‑class status.

Financial Position

Cash outflows during the quarter were primarily directed to construction activities at HMW (evaporation ponds, nano‑filtration plant fabrication, site works) and corporate overheads. Net cash used in investing activities reflected capital expenditures on plant equipment and infrastructure. Payments to related parties during the quarter totalled approximately $0.32 million for director and consulting fees.

The Galan Board has authorised the release of this December 2025 Quarterly Activities Report.

For further information contact:

COMPANY | MEDIA |

Juan Pablo ("JP") Vargas de la Vega | Matt Worner |

Managing Director | Vector Advisors |

+ 61 8 9214 2150 | +61 429 522 924 |

About Galan

Galan Lithium Limited (ASX:GLN) is an ASX-listed lithium exploration and development business. Galan's flagship assets comprise two world-class lithium brine projects, HMW and Candelas, located on the Hombre Muerto Salar in Argentina, within South America's 'lithium triangle'. Galan is distinguished by:

The size of its mineral resource. HMW is placed within the top 10 producing or development lithium projects globally, 1

The purity of its mineral resource. The HMW mineral resource has the lowest impurity profile of any published lithium brine resource in Argentina,

Positioning on the cost curve. When in production, HMW is profiled to be in the first quartile of the industry cost curve, 2

Near term production with permitted expansion. Galan is on track for first lithium chloride production in 2026 and has the construction permits to expand HMW to 21 ktpa LCE,

The RIGI. The RIGI is a large scale investment framework in Argentina which provides income tax benefits, 30 years of fiscal stability and a range of other financial benefits. Galan and Rio Tinto are the only recipients of the RIGI within the lithium industry in Argentina, and

Exploration licences at Greenbushes South in Western Australia, close to and just south of the Tier 1 Greenbushes Lithium Mine.

1 S&P Global Metals & Mining.

2 Wood Mackenzie, iLi Markets

SOURCE: Galan Lithium Limited

View the original press release on ACCESS Newswire

P.Costa--AMWN