-

Mass wedding brings hope amid destruction in Gaza

Mass wedding brings hope amid destruction in Gaza

-

German lithium project moves ahead in boost for Europe's EV sector

-

Russia, Ukraine prepare for more talks with US on ending war

Russia, Ukraine prepare for more talks with US on ending war

-

Kohli, Gaikwad tons fire India to 358-5 in South Africa ODI

-

'I feel like crying': Indonesians confront flood destruction

'I feel like crying': Indonesians confront flood destruction

-

Lebanon, Israel hold first direct talks in decades: source to AFP

-

Stock markets mostly rise awaiting US data

Stock markets mostly rise awaiting US data

-

Delhi records over 200,000 respiratory illness cases due to toxic air

-

South Korean prosecutors demand 15 years for former first lady

South Korean prosecutors demand 15 years for former first lady

-

'Dream' draw for debutants Hong Kong against Wallabies, All Blacks

-

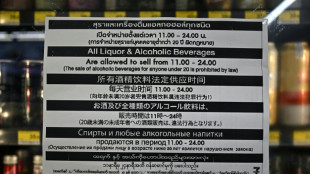

Thailand lifts ban on afternoon alcohol sales

Thailand lifts ban on afternoon alcohol sales

-

Norway postpones deep-sea mining activities for four years

-

Sri Lanka cyclone survivors face colossal clean-up

Sri Lanka cyclone survivors face colossal clean-up

-

Zara owner Inditex posts higher profits

-

Australia meet New Zealand as S. Africa face Italy at Rugby World Cup

Australia meet New Zealand as S. Africa face Italy at Rugby World Cup

-

YouTube attacks Australia's world-first social media ban

-

France's Macron in China with Ukraine on the agenda

France's Macron in China with Ukraine on the agenda

-

South Korea's ousted leader urges rallies a year after martial law

-

KFC readies finger-licking Japanese Christmas

KFC readies finger-licking Japanese Christmas

-

Stokes backs 'incredibly talented' Jacks on eve of 2nd Ashes clash

-

Airbus cuts delivery target over fuselage quality issue

Airbus cuts delivery target over fuselage quality issue

-

Stokes 'hit hard' by death of England batting great Smith

-

EU agrees deal to ban Russian gas by autumn 2027

EU agrees deal to ban Russian gas by autumn 2027

-

South Korea overcame 'crisis', leader says year after martial law

-

Ukraine war fuels debate on neutrality in Austria

Ukraine war fuels debate on neutrality in Austria

-

UK seniors fight loneliness with tea and a tango

-

How anti-China disinformation shaped South Korea's year of crisis

How anti-China disinformation shaped South Korea's year of crisis

-

Indian rupee hits fresh record low past 90 per dollar

-

Thunder beat Warriors to bag 13th straight win, Celtics down Knicks

Thunder beat Warriors to bag 13th straight win, Celtics down Knicks

-

Five-wicket Duffy puts New Zealand on top against West Indies

-

US, Russia find 'no compromise' on territory after Ukraine talks

US, Russia find 'no compromise' on territory after Ukraine talks

-

Sri Lanka counts cyclone cost as toll hits 465

-

Inglis to get nod for second Ashes Test as Cummins comeback rumours grow

Inglis to get nod for second Ashes Test as Cummins comeback rumours grow

-

Opium poppy farming hits 10-year high in war-torn Myanmar

-

South Korean leader says country overcame 'crisis' on martial law anniversary

South Korean leader says country overcame 'crisis' on martial law anniversary

-

Frustration in Indonesia as flood survivors await aid

-

Brown scores 42 as Celtics hold off Knicks

Brown scores 42 as Celtics hold off Knicks

-

Malaysia says search for long-missing flight MH370 to resume

-

McIlroy wants more big trophies, Ryder Cups, starting in Australia

McIlroy wants more big trophies, Ryder Cups, starting in Australia

-

YouTube says Australia social media ban makes children 'less safe'

-

Chinese smart glasses firms eye overseas conquest

Chinese smart glasses firms eye overseas conquest

-

New Zealand strike as West Indies lose brave Hope to be 120-5

-

Most Asian markets rise as traders await key US data

Most Asian markets rise as traders await key US data

-

Tens of thousands of Gazans need medical evacuation: MSF

-

Stokes prefers media heat in Australia to 'miserable, cold' England

Stokes prefers media heat in Australia to 'miserable, cold' England

-

Italy's luxury brands shaken by sweatshop probes

-

France's Macron visits China with Ukraine on the agenda

France's Macron visits China with Ukraine on the agenda

-

In Data Center Alley, AI sows building boom, doubts

-

Women don fake mustaches in LinkedIn 'gender bias' fight

Women don fake mustaches in LinkedIn 'gender bias' fight

-

Doctor to be sentenced for supplying Matthew Perry with ketamine

Stock markets mostly rise awaiting US data

European and Asian stock markets mostly rose Wednesday following a resumption of Wall Street's rally, but gains were muted as investors await the last tranche of US data before next week's Federal Reserve meeting.

With a cut to US interest rates expected, trading has softened ahead of key indicators this week that could still play a role in the central bank's planning over the next year.

Most in focus are the private jobs report from payrolls firm ADP on Wednesday and Friday's personal consumption expenditure (PCE) index -- the Fed's preferred gauge of inflation.

"The justification for a rate cut next week centres around weakness in the (US) jobs market," noted Joshua Mahony, chief market analyst at trading group Scope Markets.

"While we are seeing confidence return for the US tech stocks, fears around an AI bubble will undoubtedly play a key role for investors going forward," he added.

Money markets have put the chances of a December 10 cut at around 90 percent, with another three forecast by the end of next year, weighing on the dollar.

The pound was up 0.5 percent against the dollar on UK data showing stronger than expected activity from the British services sector.

Stronger sterling weighed on London's benchmark FTSE 100 stock index, which features major companies earning in dollars.

Optimism over US rate cuts has meanwhile won an additional boost from reports that President Donald Trump's top economic adviser Kevin Hassett -- a proponent of more reductions -- is the frontrunner to take the helm at the Fed when Jerome Powell's tenure ends in May.

While a number of bank decision-makers have thrown their hat in the ring for a reduction, there remains differences on the policy board about the need to target the soft labour market or stubbornly high inflation.

Elsewhere on Wednesday, the Indian rupee weakened past 90 per dollar for the first time, extending declines through the year as New Delhi struggles to strike a trade deal with the United States.

- Key figures at around 1050 GMT -

London - FTSE 100: DOWN 0.2 percent at 9,680.66 points

Paris - CAC 40: FLAT at 8,073.80

Frankfurt - DAX: UP 0.2 percent at 23,751.63

Tokyo - Nikkei 225: UP 1.1 percent at 49,864.68 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,760.73 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,878.00 (close)

New York - Dow: UP 0.4 percent at 47,474.46 (close)

Euro/dollar: UP at $1.1665 from $1.1622 on Tuesday

Pound/dollar: UP at $1.3283 from $1.3209

Dollar/yen: DOWN at 155.52 yen from 155.86 yen

Euro/pound: DOWN at 87.81 pence from 88.00 pence

Brent North Sea Crude: UP 1.3 percent at $63.26 per barrel

West Texas Intermediate: UP 1.5 percent at $59.52 per barrel

D.Moore--AMWN