-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

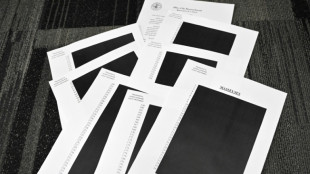

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

-

Who Is the Best Plastic Surgery Marketing Company?

Who Is the Best Plastic Surgery Marketing Company?

-

Snaplii Simplifies Holiday Gifting with Smart Cash Gift Cards, Built-In Savings

-

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

-

Flushing Bank Expands Presence in Chinatown with Opening of New Branch

-

Starring Georgia Announces Plans to Carry Out a Comprehensive Rehabilitation of the Tbilisi State Concert Hall

Starring Georgia Announces Plans to Carry Out a Comprehensive Rehabilitation of the Tbilisi State Concert Hall

-

Universal EV Chargers Scales Driver-First DC Fast Charging in 2025, Commissioning 320 Live Ports Across Key U.S. Markets

-

Nextech3D.ai Provides Shareholder Update on Krafty Labs Acquisition and Announces New CEO Investment

Nextech3D.ai Provides Shareholder Update on Krafty Labs Acquisition and Announces New CEO Investment

-

The Alkaline Water Company Announces Capital Structure Reset and Strategic Alignment Ahead of Regulation A Offering

Vero Technologies Celebrates Five Years Leading Asset Finance Innovation

NEW YORK CITY, NEW YORK / ACCESS Newswire / December 23, 2025 / Vero Technologies, a financial technology platform built for asset and wholesale finance, marked its five-year anniversary in October and a period of sustained growth across its software and services business. Founded in 2020 by Co-Founders John Mizzi and Isaac Zafarani, Vero set out to replace fragmented legacy systems and manual workflows with a unified operating system for wholesale and inventory finance.

Over the past five years, Vero has expanded from its early focus in floorplan lending to a broader asset finance footprint, supporting lenders across funding, servicing, risk management, audits, customer experience, and analytics. The platform is purpose-built for tri-party workflows, offering dedicated portals for lenders, dealers, and suppliers to improve visibility, control, and coordination across portfolios.

"Reaching the five-year mark with strong momentum across our SaaS and services business is a testament to the pain points we set out to address for our market," said John Mizzi, Co-Founder and CEO. "We've evolved into a strategic partner for banks and specialty finance companies that want scalable, data-driven programs and tighter operational control without taking on complex internal builds."

In its early years, Vero operated a direct lending program under the Lever Auto brand as an initial development partner and proving ground for the technology, generating real-world feedback that accelerated the platform roadmap. Vero has since completed the wind-down of that portfolio and is now fully focused on delivering software and services that enable other lenders.

"The last five years have been about building a modular platform that meets lenders where they are, then giving them a clear path to modernize without a disruptive rip-and-replace," said Isaac Zafarani, Co-Founder and Chief Operating Officer. "Our work in title management, risk analytics, audit automation, and now AI-driven risk monitoring and portfolio insights reflects a consistent objective: to help lenders manage their portfolios with more precision and significantly less manual effort."

Today, Vero supports a growing pipeline of banks, captives, and independent lenders across equipment, powersports, RV, and auto verticals, backed by venture and credit investors with deep experience in financial services and technology. As the company looks ahead to its next phase, Vero remains focused on strengthening the infrastructure that underpins asset finance, giving lenders the tools to operate more efficiently, respond faster to market conditions, and deliver a better experience to their dealer and borrower customers.

About Vero Technologies: Vero Technologies is a leading financial technology platform for asset finance, providing end-to-end solutions for wholesale finance, trade finance, equipment finance, and title management. Vero's modular platform enables lenders to streamline loan servicing, risk monitoring, and operational workflows, enhancing efficiency while reducing costs.

About Vero Technologies: Vero Technologies is a leading financial technology platform for asset finance, providing end-to-end solutions for wholesale finance, trade finance, equipment finance, and title management. Vero's modular platform enables lenders to streamline loan servicing, risk monitoring, and operational workflows, enhancing efficiency while reducing costs.

To learn more, visit: www.vero-technologies.com

Contact: Jason Bartz, [email protected], 404-383-7048

SOURCE: Vero Finance Technologies

View the original press release on ACCESS Newswire

M.A.Colin--AMWN