-

Ineos snap up Scotsman Onley

Ineos snap up Scotsman Onley

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

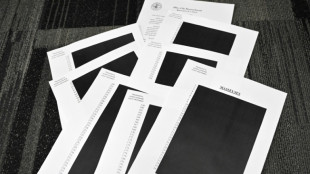

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

Gold's Trust Model Is Being Rebuilt Around Infrastructure, SMX Is Writing the Blueprint

NEW YORK, NY / ACCESS Newswire / December 23, 2025 / For much of the modern gold trade, trust has been delegated to individual companies. Refiners certified their suppliers. Traders vouched for counterparties. Documentation followed the metal, often across borders and jurisdictions that applied standards unevenly.

That model is breaking down. As global gold markets tighten expectations around responsible sourcing, AML, and ESG compliance, trust is increasingly being evaluated at the jurisdictional level. Markets are no longer asking whether a single participant claims compliance. They are asking whether the environment in which gold is produced, refined, and exported can consistently enforce it.

This shift is redefining how credibility is earned and reshaping where infrastructure must be built.SMX (NASDAQ:SMX) is aligning its precious-metals strategy with that reality.

Putting Extra Shine on Gold

Following its engagement with the Dubai Multi Commodities Centre, the company has moved rapidly into jurisdiction-anchored initiatives, including its newest collaborations with Bougainville Refinery Ltd and digital identity provider FinGo.

The objective is not limited to certifying individual transactions. It is to evaluate how advanced authentication and identity infrastructure can be embedded directly into national-scale supply-chain operations, where enforcement actually matters.

The distinction is critical.

Company-level compliance can be fragmented. Jurisdiction-level infrastructure creates consistency. When verification systems are embedded where sourcing, refining, and export intersect, trust becomes systemic rather than discretionary.

SMX's role in this transition begins with the material itself. Its molecular-level authentication technology embeds a persistent, invisible identity directly into gold, creating a physical-digital link that survives refining and downstream processing. This ensures that gold remains verifiable regardless of ownership changes or processing stages, a prerequisite for jurisdiction-wide enforcement.

More Than the Sum of Its Parts

TrueGold, a majority-owned subsidiary of SMX, builds on this foundation by positioning verified gold as a distinct, compliant asset class. In a market where regulators and counterparties increasingly differentiate between documented claims and demonstrable proof, this distinction gives jurisdictions a mechanism to offer gold that carries trusted identity by design, not by assertion.

Human identity completes the framework. Jurisdictional trust does not rest solely on material integrity. It depends on accountability across the people who extract, aggregate, refine, and export gold. FinGo's biometric digital identity infrastructure enables verified attribution of actions and custody changes to real individuals aligned with KYC and AML expectations, including in environments where traditional identity systems are limited or unreliable.

By linking verified humans to verified material at each supply-chain event, the system creates records that withstand scrutiny across borders. This is precisely what jurisdictional credibility requires.

Bougainville Refinery Ltd provides the operational context that elevates the initiative beyond concept. As a licensed refinery and exporter, BRL operates at the point where national policy meets international markets. Embedding SMX and FinGo technologies into real sourcing, refining, and export workflows demonstrates how jurisdictions can operationalize transparency rather than merely legislate it.

A Strategic, Collaborative Effort

The broader implication is strategic. Gold markets are increasingly rewarding environments that can deliver consistency, auditability, and trust at scale. Jurisdictions that can offer verifiable supply chains reduce risk for refiners, financiers, and end markets alike. Those who cannot face growing friction.

SMX's sequencing reflects an understanding of this shift. Alignment with global market authorities first. Deployment within operational jurisdictions next. Replication as credibility compounds. This is how standards are set in practice, not by decree, but by adoption.

Gold has always been a global asset. Increasingly, it is also a geopolitical one. The future of trusted gold will be shaped not only by companies that comply, but by jurisdictions that can prove it.

By enabling material identity, human accountability, and auditable operations at scale, SMX is positioning itself at the intersection where technology meets sovereignty, and where trust becomes infrastructure.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

This information contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements are based on current expectations, estimates, forecasts, and assumptions regarding future events involving SMX (NASDAQ: SMX), its technologies, its partnership activities, and its development of molecular marking systems for recycled PET and other materials. Forward looking statements are not historical facts. They involve risks, uncertainties, and factors that may cause actual results to differ materially from those expressed or implied.

Forward looking statements in this editorial include, but are not limited to, expectations regarding the integration of SMX's molecular markers into U.S. recycling markets; the potential for FDA-compliant markers to enable recycled PET to enter food-grade and other regulated applications; the scalability of SMX solutions across diverse global supply chains; anticipated adoption of identity-based verification systems by manufacturers, recyclers, regulators, or brand owners; the potential economic impact of turning recycled plastics into tradeable or monetizable assets; the expected performance of SMX's Plastic Cycle Token or other digital verification instruments; and the belief that molecular-level authentication may influence pricing, compliance, sustainability reporting, or financial strategies used within the plastics sector.

These forward looking statements are also subject to assumptions regarding regulatory developments; market demand for authenticated recycled content; the pace of corporate adoption of traceability technology; global economic conditions; supply chain constraints; evolving environmental policies; and general industry behavior relating to sustainability commitments and recycling mandates. Risks include, but are not limited to, changes in FDA or international regulatory standards; technological challenges in large-scale deployment of molecular markers; competitive innovations from other companies; operational disruptions in recycling or plastics manufacturing; fluctuations in pricing for virgin or recycled plastics; and the broader economic conditions that influence capital investment and industrial activity.

Detailed risk factors are described in SMX's filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward looking statements. These statements speak only as of the date of publication. SMX undertakes no obligation to update or revise forward looking statements to reflect subsequent events, changes in circumstances, or new information, except as required by applicable law.

EMAIL: [email protected]

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire

F.Pedersen--AMWN