-

No.1 Jeeno surges clear at LPGA Tour Championship

No.1 Jeeno surges clear at LPGA Tour Championship

-

Paul backs his 'delusional optimism' to upset Joshua

-

Bolivia says US drug agency to return to aid cocaine battle

Bolivia says US drug agency to return to aid cocaine battle

-

Zelensky says US plan means Ukraine loses 'dignity' - or an ally

-

Marseille wallop Nice to climb top in France

Marseille wallop Nice to climb top in France

-

Pau eclipse returning Jalibert to take Top 14 lead

-

Leftist NY mayor-elect and Trump make nice in White House love-in

Leftist NY mayor-elect and Trump make nice in White House love-in

-

Over 220 pupils and teachers kidnapped from Nigerian school

-

UN climate summit pushes into overtime as nations clash over fossil fuels

UN climate summit pushes into overtime as nations clash over fossil fuels

-

US stocks gain momentum after tech-fueled Asia rout

-

Italy edge into Davis Cup final with epic tie-break

Italy edge into Davis Cup final with epic tie-break

-

Defiant Townsend determined to stay on as Scotland boss

-

Guinea-Bissau youth hope presidential vote brings better life

Guinea-Bissau youth hope presidential vote brings better life

-

Brazil's Bolsonaro seeks to serve 27-year jail term under house arrest

-

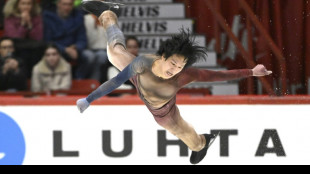

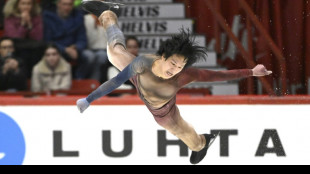

US skater Glenn and France's Siao lead the way at Finlandia Trophy

US skater Glenn and France's Siao lead the way at Finlandia Trophy

-

Trump's plan to end war pushed back by Zelensky, welcomed by Putin

-

Premier League clubs overhaul financial rules

Premier League clubs overhaul financial rules

-

Leftist New York mayor-elect faces Trump in White House showdown

-

What are Russian forces doing in Mali amid jihadist blocade?

What are Russian forces doing in Mali amid jihadist blocade?

-

Modest momentum for US stocks after tech-fuelled Asia rout

-

Fugees rapper Pras Michel sentenced to 14 years in prison

Fugees rapper Pras Michel sentenced to 14 years in prison

-

England's Dingwall out of Argentina clash

-

French skater Siao Him Fa leads at ISU Finlandia Trophy

French skater Siao Him Fa leads at ISU Finlandia Trophy

-

Bangladesh quake kills nine, injures hundreds

-

Irish captain Doris says 'a lot on the line' in South Africa Test

Irish captain Doris says 'a lot on the line' in South Africa Test

-

Zelensky rebuffs US plan to end war, says won't 'betray' Ukraine

-

Tuipulotu keeps Scotland place as Townsend makes 14 changes for Tonga

Tuipulotu keeps Scotland place as Townsend makes 14 changes for Tonga

-

Spotlight on All Blacks coach Robertson ahead of Wales season-ender

-

Man Utd forward Sesko out 'for a few weeks'

Man Utd forward Sesko out 'for a few weeks'

-

Gabriel faces 'weeks' out of action in major blow for Arsenal

-

US stocks creep ahead after tech-fuelled Asia rout

US stocks creep ahead after tech-fuelled Asia rout

-

Arsenal defender Gabriel faces 'weeks' on sidelines

-

EU to seek more tariff exemptions during US commerce secretary visit

EU to seek more tariff exemptions during US commerce secretary visit

-

COP30 deal under threat as nations clash over fossil fuels

-

How US sanctions on Russia's Lukoil hit Bulgaria's largest refinery

How US sanctions on Russia's Lukoil hit Bulgaria's largest refinery

-

Pogba still 'has the qualities', says Monaco coach Pocognoli

-

Nations at odds over fossil fuels as COP30 draws to a close

Nations at odds over fossil fuels as COP30 draws to a close

-

European stocks fall after tech-fuelled Asia rout

-

Australia's seven-wicket hero Starc ready to go again

Australia's seven-wicket hero Starc ready to go again

-

Pupils, teachers kidnapped from Catholic school in central Nigeria

-

Guardiola says 'season starts now' as Man City hunt Arsenal

Guardiola says 'season starts now' as Man City hunt Arsenal

-

Mercedes chief Wolff sells part of team stake to US businessman

-

Ubisoft shares surge as trading resumes after results 'restatement'

Ubisoft shares surge as trading resumes after results 'restatement'

-

Olympic ski champion Gut-Behrami suffers knee injury

-

Ukraine cornered by US plan heeding Russian demands

Ukraine cornered by US plan heeding Russian demands

-

Europe increasingly 'vulnerable' to shocks: ECB chief

-

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

Slot says Liverpool will never use Jota grief as 'excuse' for poor form

-

Aussie Wilson 'devastated' after Gordon ruled out of France Test

-

Ken Follett: 'There can't be boring bits in my books'

Ken Follett: 'There can't be boring bits in my books'

-

Wales rugby turmoil here to stay as nostalgia battles financial reality

US stocks gain momentum after tech-fueled Asia rout

US markets advanced Friday while European counterparts marked time, in response to sharp losses in Asia at the end of a week which saw heightened fears of a bursting AI bubble.

A blockbuster earnings report from chip bellwether Nvidia on Wednesday seemed to soothe concerns that vast investments in the artificial intelligence sector may have been overdone.

But Nvidia shares closed one percent lower on Wall Street as warnings grew that the tech-led rally may have run its course across equities. This had seen several markets hit record highs and companies clock eye-watering capitalizations.

Adding to unease were mixed US September jobs data released Thursday that raised the possibility that the Federal Reserve could decide against cutting interest rates in December.

That unease spread to Asia, with Tokyo, Hong Kong and Shanghai all ending the week down almost 2.5 percent at the close.

The clouds began to clear to a degree, however, as the Dow climbed 1.1 percent by end-Friday, while the tech-heavy Nasdaq added 0.9 percent and the broader-based S&P 500 rose 1.0 percent.

"This week's sharp sell-off in US stocks and cryptocurrencies briefly stalled as Fed December rate cut expectations increased from 41 percent to 73 percent after New York Fed President John Williams suggested the Fed may cut rates again soon," said Axel Rudolph, senior technical analyst at IG.

But Angelo Kourkafas of Edward Jones added of the central bank: "The fact that we're not going to get some key data does not make their job easier."

This week, the US Bureau of Labor Statistics said it would not publish full employment and consumer inflation reports for the month of October -- while November figures will only be released after the next central bank interest rate meeting.

This adds to the fog that Fed officials have to navigate as they mull their next rate decision.

Europe lacked direction as London ended just a sliver in the green. Paris was flat -- although Ubisoft provided a glimmer of light -- while Frankfurt lost 0.8 percent.

French video game company Ubisoft resumed trading in Paris, a week after stunning investors by postponing its results announcement without an explanation, triggering speculation in the video gaming world.

The "Assassin's Creed" maker said Friday the move was due to a simple "restatement" of its half-yearly results after new auditors found problems with the way it had accounted for a partnership.

The rush from risk assets saw digital currrency bitcoin hit a seven-month low at $81,569.79 before pulling back to around $84,490 -- extending a sell-off suffered since its record high above $126,200 last month.

"The price action across markets has been prolific, and we've seen some truly impressive reversals in risk assets," said analyst Chris Weston at broker Pepperstone.

"Sentiment in so many markets remains highly challenged, and we've seen new evidence that managers are dumping their 2025 winners -- raising expectations that the path of least resistance is for risk to trade lower in the near-term," he added.

- Key figures at around 2105 GMT -

New York - Dow: UP 1.1 percent at 46,245.41 points (close)

New York - S&P 500: UP 1.0 percent at 6,602.99 (close)

New York - Nasdaq Composite: UP 0.9 percent at 22,273.08 (close)

London - FTSE 100: UP 0.1 percent at 9,539.71 (close)

Paris - CAC 40: FLAT at 7,982.65 (close)

Frankfurt - DAX: DOWN 0.8 percent at 23,091.87 (close)

Tokyo - Nikkei 225: DOWN 2.4 percent at 48,625.88 (close)

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 25,220.02 (close)

Shanghai - Composite: DOWN 2.5 percent at 3,834.89 (close)

Dollar/yen: DOWN at 156.39 yen from 157.55 yen on Thursday

Euro/dollar: DOWN at $1.1519 from $1.1525

Pound/dollar: UP at $1.3107 from $1.3070

Euro/pound: DOWN at 87.88 from 88.18 pence

Brent North Sea Crude: DOWN 1.3 percent at $62.56 per barrel

West Texas Intermediate: DOWN 1.6 percent at $58.06 per barrel

L.Miller--AMWN