-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

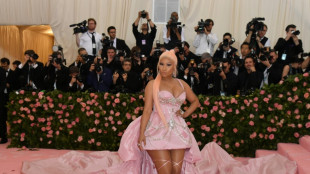

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Markets mostly rise as rate cut hopes bring Christmas cheer

Most markets rose Tuesday, while gold and silver hit fresh records as optimism for more US interest rate cuts and an easing of AI fears helped investors prepare for the festive break on a positive note.

Data showing US unemployment rising and inflation slowing gave the Federal Reserve more room to lower borrowing costs and provided some much-needed pep to markets after a recent swoon.

That was compounded by a blockbuster earnings report from Micron Technologies that reinvigorated tech firms.

The sector has been the key driver of a surge in world markets to all-time highs this year owing to huge investments into all things artificial intelligence but that trade has been questioned in recent months, sparking fears of a bubble.

With few catalysts to drive gains on Wall Street, tech was again at the forefront of buying Monday, with chip titan Nvidia and Tesla leading the way.

"The amount of money being thrown towards AI has been eye-watering," wrote Michael Hewson of MCH Market Insights.

He said the vast sums pumped into the sector "has inevitably raised questions as to how all of this will be financed, when all the companies involved appear to be playing a game of pass the parcel when it comes to cash investment".

"These deals also raise all manner of questions about how this cash will generate a longer-term return on investment," he added.

"With questions now being posed... we may start to get a more realistic picture of who the winners and losers are likely to be, with the losers likely to be punished heavily."

Asian markets enjoyed a bright start though some stuttered as the day wore on.

Sydney, Seoul, Shanghai, Sydney, Singapore, Taipei, Wellington, Bangkok and Jakarta were all higher, while Tokyo and Mumbai were flat.

Hong Kong and Manila dipped.

Precious metals were also pushing ever higher on the back of expectations for more US rate cuts, which makes them more attractive to investors.

Bullion jumped to a high above $4,497 per ounce, while silver was just short of $70 an ounce, with the US blockade against Venezuela and the Ukraine conflict adding a geopolitical twist.

"The structural tailwinds that have driven both of these to record highs this year persist, be it central bank demand for gold or surging industrial demand for silver," said Neil Wilson at Saxo Markets.

"The latest surge comes after soft inflation and employment readings in the US last week, which reinforced expectations around the Fed's policy easing next year. Geopolitics remains a factor, too."

On currency markets, the yen extended gains after Japan's Finance Minister Satsuki Katayama flagged authorities' powers to step in to support the unit, citing speculative moves in markets.

The yen suffered heavy selling after Bank of Japan boss Kazuo Ueda held off signalling another rate hike anytime soon following last week's increase.

"The moves (on Friday) were clearly not in line with fundamentals but rather speculative," Katayama told Bloomberg on Monday.

"Against such movements, we have made clear that we will take bold action, as stated in the Japan–US finance ministers' joint statement," she added.

Oil prices dipped, having jumped more than two percent Monday on concerns about Washington's measures against Caracas.

The United States has taken control of two oil tankers and is chasing a third, after President Donald Trump last week ordered a blockade of "sanctioned" tankers heading to and leaving Venezuela.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: FLAT at 50,412.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,764.84

Shanghai - Composite: UP 0.1 percent at 3,919.98 (close)

Dollar/yen: DOWN at 156.08 yen from 156.99 yen on Monday

Euro/dollar: UP at $1.1774 from $1.1756

Pound/dollar: UP at $1.3487 from $1.3458

Euro/pound: DOWN at 87.30 pence from 87.35 pence

West Texas Intermediate: DOWN 0.4 percent at $57.77 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $61.83 per barrel

New York - Dow: UP 0.5 percent at 48,362.68 (close)

London - FTSE 100: DOWN 0.3 percent at 9,865.97 (close)

P.Costa--AMWN