-

'Public lynching': Senegal cracks down on LGBTQ+ community

'Public lynching': Senegal cracks down on LGBTQ+ community

-

Hong Kong sentences father of wanted activist to 8 months in jail

-

The woman fighting to reclaim her face from Albania's 'AI minister'

The woman fighting to reclaim her face from Albania's 'AI minister'

-

Bulgaria ski station becomes refuge for digital nomads

-

Thai runner-up party seeks criminal case against election officials

Thai runner-up party seeks criminal case against election officials

-

North Korea's Kim shuns South but could 'get along' with US

-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

Post-uprising polls won't shake Nepal's delicate India-China balance

-

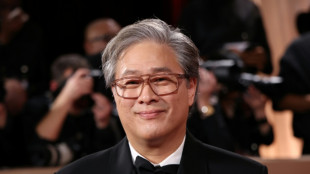

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

Pakistani sculptor turns scrap into colossal metal artworks

-

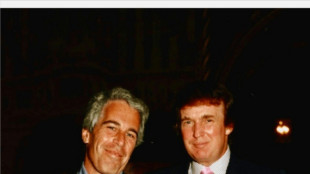

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

-

Connecting Excellence Group PLC Announces H1 2026 Trading Update

Connecting Excellence Group PLC Announces H1 2026 Trading Update

-

Empire Metals Limited Announces DTC Eligibility

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 26

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 26

-

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

How I-ON Digital and it's Flagship ION.au Stablecoin Align with the National Digital Asset Policy Framework

Setting the Gold Standard for Responsible Digital Finance Under the National Framework

CHICAGO, ILLINOIS / ACCESS Newswire / August 6, 2025 / In response to the evolving landscape of digital finance, the U.S. government's "Comprehensive Framework for Responsible Development of Digital Assets," originally driven by Executive Order 14067, outlines a clear vision: integrate digital assets into the U.S. financial system in a way that supports innovation, safeguards consumers, and enhances economic security.

At I-ON Digital Corp. (OTCQB:IONI), we believe our institutional-grade infrastructure, regulatory alignment, and gold-backed stablecoins are uniquely positioned to advance the United States' national objectives around financial innovation, economic resilience, and digital asset leadership. Here's how:

1. Gold-Backed Transparency & Stability

ION.au is a next-generation asset-backed security (ABS) token engineered to deliver institutional-grade trust, combining the transparency of blockchain with the intrinsic value of gold. Priced based on the LBMA Gold Price benchmark, it offers:

Fully auditable ownership and asset tracking

Backed by real-world gold at a 5:1 reserve ratio, ensuring unmatched stability and trust.

A foundational role across both decentralized finance (DeFi) and traditional financial systems

This structure directly aligns with the regulatory framework's emphasis on responsible innovation - anchored in real-world value, transparency, and financial stability.

2. Compliant Financial Instrumentation

ION.au is purpose-built to satisfy the highest global standards for digital asset compliance and classification, offering a level of financial rigor expected by institutional investors and regulators alike. It adheres to:

ASC 820 (Fair Value Measurement)

IFRS 9 (Financial Instruments)

SEC Regulation AB & Rule 144A (Securitization & Private Resale)

ESMA (European Securities and Markets Authority) guidelines

This robust compliance framework supports the broader regulatory agenda of integrating digital assets into mainstream financial markets - while prioritizing transparency, investor protection, and cross-border interoperability.

3. Institutional-Grade Blockchain Infrastructure

I-ON's Digital Asset Platform (DAP) delivers a robust foundation for secure and compliant digital finance by providing:

Rigorous asset ownership attestation and verification

Integrated KYC/AML onboarding protocols

Smart contract-based asset issuance and management

AI-driven treasury operations and real-time compliance monitoring

AI-assisted treasury and compliance

These core capabilities directly align with federal objectives for financial interoperability, enhanced anti-money laundering (AML) enforcement, and the scalable deployment of next-generation digital asset infrastructure.

4. Enabling U.S. Competitiveness and Financial Sovereignty

I-ON is strategically advancing public and private sector engagement to help reinforce America's leadership in digital finance, by working with:

Banks pursuing tokenized reserve assets to enhance balance sheet utility

Financial institutions preparing to onboard, custody, process, trade, and report on fully compliant, institutional-grade digital assets

Treasury departments evaluating gold-backed instruments as stable, sovereign alternatives

State and regional governments - such as Texas - seeking greater financial autonomy through precious metals

These initiatives directly support the national framework's focus on economic competitiveness, financial sovereignty, and leadership in digital asset innovation.

5. Supporting the Future of Programmable Money

ION.au can integrate seamlessly with tokenized payment rails such as FedNow and a wide variety of stablecoins, offering traceable, collateralized value behind every transaction. Our infrastructure enables programmable compliance and institutional-grade transparency - an essential feature highlighted in the federal framework.

At I-ON Digital, we're not just building technology - we're helping shape a compliant, transparent, and secure future for U.S. digital finance, as well as forward-thinking solutions for the TradFi and DeFi markets, and thus playing a leadership role in the Open Finance marketplace. Learn more about how we're enabling tokenized assets, sovereign gold-backed instruments, and institutional-grade Digital Asset Platform (DAP).

Articles of Interest:

https://cointelegraph.com/news/trump-admin-releases-promised-crypto-report

https://www.axios.com/newsletters/axios-crypto-2b877590-6d7e-11f0-b81d-59f897f31e40

https://cointelegraph.com/news/white-house-crypto-report-bitcoin-reserve

For further information, please contact:

Press Relations

I-ON Digital Corp.

[email protected]

(866) 440-2278

https://iondigitalcorp.com

SOURCE: I-ON Digital Corp

View the original press release on ACCESS Newswire

T.Ward--AMWN