-

Tudor says Tottenham can still beat the drop despite Arsenal loss

Tudor says Tottenham can still beat the drop despite Arsenal loss

-

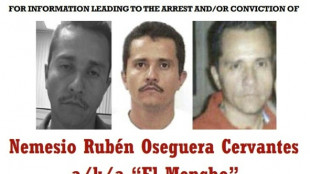

Violence sweeps Mexico after most-wanted drug cartel leader killed

-

France giant Meafou capable of being 'world's best' lock

France giant Meafou capable of being 'world's best' lock

-

World champions South Africa announce eight home Tests for 2026/27

-

Liverpool boss Slot encouraged by Mac Allister's return to form

Liverpool boss Slot encouraged by Mac Allister's return to form

-

India replaces British architect statue with independence hero

-

Pakistan warn England's flaky batting to expect a trial by spin

Pakistan warn England's flaky batting to expect a trial by spin

-

Philippines' Duterte authorised murders, ICC told as hearings open

-

Iran says would respond 'ferociously' to any US attack, even limited strikes

Iran says would respond 'ferociously' to any US attack, even limited strikes

-

New Dutch government sworn in under centrist Jetten

-

What the future holds for the CJNG cartel after leader killed

What the future holds for the CJNG cartel after leader killed

-

ICC kicks off pre-trial hearing over Philippines' Duterte

-

UN chief decries global rise of 'rule of force'

UN chief decries global rise of 'rule of force'

-

Nemesio Oseguera, the brutal Mexican drug lord known as 'El Mencho'

-

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

-

New York orders citywide travel ban as major storm hits US

-

'Considered a traitor': Life of an anti-war Ukrainian in Russia

'Considered a traitor': Life of an anti-war Ukrainian in Russia

-

South Korea and Brazil sign deals on K-beauty, trade

-

Zimbabwe farmers seek US help over long-promised payouts

Zimbabwe farmers seek US help over long-promised payouts

-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

Hong Kong appeals court to rule on jailed democracy campaigners

-

Dynamite Blockchain Provides Milestone Update on MOT Token Holding

-

Intercompany Solutions Publishes New 2025 Startup Formation Snapshot 25 Percent of Client Incorporations Classified as High-Tech

Intercompany Solutions Publishes New 2025 Startup Formation Snapshot 25 Percent of Client Incorporations Classified as High-Tech

-

Black Book Research Publishes "Germany: State of Acute Care EHR and Digital Health 2026"

-

Are Major LGBTQ Dating Apps a Hidden Privacy Risk?

Are Major LGBTQ Dating Apps a Hidden Privacy Risk?

-

Stewart Law Offices Ranked by Best Law Firms in 2026

-

SICPA Secures Major European Award for UK Vaping Duty Stamps Program

SICPA Secures Major European Award for UK Vaping Duty Stamps Program

-

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

-

AGTech to Help Build One-Stop Trading Services Platform as Hong Kong Gold Exchange Opens for the Year of the Horse

AGTech to Help Build One-Stop Trading Services Platform as Hong Kong Gold Exchange Opens for the Year of the Horse

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

-

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

-

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

-

Top Mexican drug cartel leader killed

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

How Diginex Is Turning Global Compliance Backlogs Into a Scalable Business Model

LONDON, GB / ACCESS Newswire / December 1, 2025 / There's a global traffic jam hidden inside modern commerce. It's not on the roads or in the ports. It sits inside compliance offices, audit queues, forced-labor checks, emissions calculations, and ESG verification cycles that have grown slower and more complex every year.

Companies can't move inventory, sign contracts, or ship products without passing through these checkpoints. As if that weren't enough, regulators are adding rules faster than companies can respond. That's leaving many auditors struggling to keep pace with new reporting standards, which have changed what used to be a back-office function into one of the biggest bottlenecks in global business. Diginex (NASDAQ:DGNX) is stepping directly into that bottleneck with a platform built to break it open.

This shift didn't happen overnight. The last couple of quarters have revealed a company assembling the pieces of a compliance engine that removes the friction slowing the world's regulatory machinery. The MOU to acquire Kindred OS injects Edge AI into risk detection and analysis, reducing the manual work that traditionally slows auditors down. The MOU to acquire The Remedy Project brings human rights remediation into the workflow, something most ESG platforms can't match. Add in diginexGHG, the company's AI-powered emissions engine, along with its audit-ready sustainability reporting tools and existing due diligence frameworks, and the picture becomes clear. Diginex isn't building a tool. It's building throughput.

Where the Bottleneck Began

The market needs it. Every year, global brands lose time and money waiting for compliance checks to clear. A supplier stuck in a forced-labor review loses revenue. A manufacturer with incomplete emissions reporting risks losing market access. Importers dealing with UFLPA delays under the United States Uyghur Forced Labor Prevention Act face expensive slowdowns. Companies working through CSRD obligations under Europe's Corporate Sustainability Reporting Directive often wait weeks for clearance. These pain points are predictable, recurring, and global. They create a commercial environment where any platform that accelerates verification can own the customer relationship. Diginex is moving into that role with precision.

The root of the problem is structural. Regulations across Europe, the United States, and Asia expanded faster than compliance systems evolved. CSRD introduced thousands of required data points that companies must produce for sustainability and governance transparency. The UFLPA forced importers to show verifiable evidence of clean supply chains before goods could enter US ports. Asian markets are preparing digital product passport systems that require traceable, immutable sustainability data for millions of goods. All of this has left auditors overwhelmed and companies scrambling. Not because they lack ability but because legacy reporting and compliance systems weren't built for this level of scrutiny.

Most ESG tools were built for a lighter era. They helped companies publish sustainability reports with attractive charts and polished narratives. That era is over. Regulators and investors now demand evidence, not commentary. They want data provenance, corrective-action tracking, authenticated emissions records, and verified supply-chain events. In other words, the market needs systems that track reality at the source. Diginex is addressing these needs by modernizing each layer of the verification cycle.

That's where the company's recent moves matter. The Remedy Project will add one of the most underserved components of the compliance process. Remediation documentation is slow, complex, and difficult to audit. Kindred OS will contribute speed, detection capabilities, and the automation needed to reduce bottlenecks before they form. Combined with diginexGHG's ability to turn emissions data into audit-ready outputs, the company is assembling a rare set of tools that shorten the gap between regulatory requirements and regulatory clearance.

A Platform Built for Volume

The most important feature of a bottleneck breaker is volume. Diginex is building a platform scaled for throughput. Emissions data doesn't sit in spreadsheets. It flows through diginexGHG. Forced-labor remediation doesn't disappear into consulting reports. It moves through a digital framework backed by The Remedy Project. Detection isn't a manual review of questionnaires. It becomes automated through Edge AI.

This changes how companies experience compliance. Instead of navigating siloed vendors for reporting, emissions, remediation, and verification, they run the entire cycle through one platform. That model does something simple but rare. It removes friction. It accelerates audits. It shortens delays. It gives companies the ability to respond to regulators in days instead of months. The value of that capability grows with every new regulation that enters the market.

The macro environment reinforces the opportunity. CSRD enforcement is rolling out in stages that will affect tens of thousands of companies across Europe. UFLPA reviews continue to intensify at US ports. Asian markets are preparing for digital passport enforcement that will require validated product-level sustainability data. Each regulatory wave adds more pressure on auditors and more delays for companies. Platforms that reduce those delays won't be optional. They'll be critical infrastructure. Diginex is positioning itself at the center of that transition.

The Business Case for a Bottleneck Breaker

The value of this model is straightforward. Compliance bottlenecks are expensive. They slow revenue, delay shipments, and create financial risk. Companies pay for anything that compresses those timelines, especially solutions that eliminate regulatory friction and produce an immediate return on investment.

Diginex is aligning itself with that demand by building a platform that aligns with the direction regulators are moving. It's building tools that solve a structural problem, not a temporary one. It's offering capabilities that global brands will increasingly treat as mandatory. That has created a rare position from which to capture opportunity.

Few small caps operate in this position. Even fewer have multiple layers of technology moving through acquisition, integration, and deployment at the same time. Diginex does. That's a good thing.

The world's compliance backlog isn't going away. Regulations aren't slowing down. And, auditors aren't catching up. That leaves the companies able to solve the bottleneck as the ones most likely to define the next generation of compliance infrastructure. Diginex has positioned itself to be one of them. Not by chance but by stepping into a global traffic jam with a platform built to keep commerce moving.

Forward-Looking Statements

This article contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that are based on current expectations and projections about future events that may affect financial condition, results of operations, business strategy, and financial performance. Forward-looking statements are often identified by words or phrases such as "believes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may," and other similar expressions.

These statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, regulatory changes, market conditions, customer adoption, integration of potential acquisitions, competitive developments, and other factors described in the Diginix Limited's filings with the Securities and Exchange Commission.

Diginix Limited undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur after the date of this article, except as required by law. Although Diginix Limited believes the expectations reflected in these statements are reasonable, it cannot provide any assurance that such expectations will prove to be correct. Investors are encouraged to review all risk factors contained in Diginix Limited's most recent SEC filings.

Media Contact for this content: [email protected]

SOURCE: Diginex Limited

View the original press release on ACCESS Newswire

P.Martin--AMWN