-

Iran says would respond 'ferociously' to any US attack, even limited strikes

Iran says would respond 'ferociously' to any US attack, even limited strikes

-

New Dutch government sworn in under centrist Jetten

-

What the future holds for the CJNG cartel after leader killed

What the future holds for the CJNG cartel after leader killed

-

ICC kicks off pre-trial hearing over Philippines' Duterte

-

UN chief decries global rise of 'rule of force'

UN chief decries global rise of 'rule of force'

-

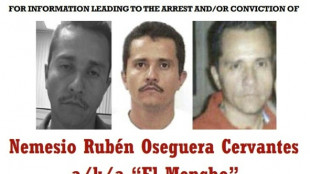

Nemesio Oseguera, the brutal Mexican drug lord known as 'El Mencho'

-

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

-

New York orders citywide travel ban as major storm hits US

-

'Considered a traitor': Life of an anti-war Ukrainian in Russia

'Considered a traitor': Life of an anti-war Ukrainian in Russia

-

South Korea and Brazil sign deals on K-beauty, trade

-

Zimbabwe farmers seek US help over long-promised payouts

Zimbabwe farmers seek US help over long-promised payouts

-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

Hong Kong appeals court to rule on jailed democracy campaigners

-

Are Major LGBTQ Dating Apps a Hidden Privacy Risk?

-

Stewart Law Offices Ranked by Best Law Firms in 2026

Stewart Law Offices Ranked by Best Law Firms in 2026

-

SICPA Secures Major European Award for UK Vaping Duty Stamps Program

-

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

-

AGTech to Help Build One-Stop Trading Services Platform as Hong Kong Gold Exchange Opens for the Year of the Horse

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

-

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

New Survey Reveals Florida Insurance Market is Turning A Corner As Carriers Focus on Experience

Consumers Report Faster Claims Handling Yet Remain Divided on Affordability and Market Stability

BOSTON, MA AND TALLAHASSEE, FL / ACCESS Newswire / December 3, 2025 / Three years after Hurricane Ian wreaked havoc on Florida and its insurance market, a new survey commissioned by Hi Marley, creators of the only intelligent conversational platform built for P&C insurance, found that the industry is showing signs of stabilization, even as consumer sentiment remains deeply split. Sixty-five percent of homeowners cite the market as a factor in their long-term plans to live in the state, demonstrating the lasting influence this topic has on local families, communities and economies.

For its Florida State of Insurance Survey, Hi Marley polled 1,000 Florida homeowners who have filed an insurance claim in the past three years and found that a majority (53 percent) agree that there are more carriers to choose from, signaling that legislative efforts to attract carriers back to Florida are succeeding. But sentiment is still divided. While 39 percent of respondents say the market is more stable than it was three years ago, another 38 percent say it is less stable or, worse, completely unstable. Cost is at the forefront of the issue, with only 5 percent of respondents reporting that their premiums decreased in the past three years.

While rising premium costs remain a concern, the survey indicates that recent reforms combined with carriers' investments in technology and communication have introduced more options and helped deliver faster, better claims experiences. Key findings include:

Carriers are streamlining the claims experience

The survey found that 80 percent of homeowners' insurance claims over the past three years resulted from hurricanes. Despite the inevitability of weather-related threats, customer experience is improving as carriers focus on what they can control: streamlining the claims process. Nearly half (47 percent) of all respondents agreed that the claims process has become faster and more efficient, and 39 percent felt that the market is changing for the better.

Claims satisfaction is high: 78 percent of homeowners reported being satisfied or very satisfied with how quickly and clearly their insurance company communicated with them during their most recent claim.

Resolution exceeds expectations: 39 percent of policyholders said their claim resolved faster than expected.

Confidence in service: 67 percent of respondents said they were satisfied or very satisfied with their current insurance carrier's overall customer service. Furthermore, 57 percent agree that their insurance company is doing its best to help customers.

A divided outlook

While 64 percent reported their premiums increased in the last three years, there are signs that the market is beginning to turn a corner, with many consumers noticing more options and gaining confidence.

Building trust: 43 percent report that their trust in insurance companies increased in the past three years.

Better communication: 46 percent agree that insurance companies are communicating more clearly.

Policy affordability: 41 percent believe that it is getting easier to find an affordable policy today.

Overall market improvements: 39 percent say that the overall market is changing for the better.

But a near-identical number of respondents indicated the opposite - 38 percent disagree that the market is changing for the better, and 41 percent do not believe it's getting easier to find an affordable policy.

"This division exposes a critical issue: the market may be attracting more carriers, but the reforms have yet to deliver tangible financial relief," said Hugh Allen, Principal Product Strategist at Hi Marley. "Carriers and legislators still have work to do to instill consumer confidence, especially for those in coastal areas more prone to catastrophic events."

Digital tools have helped drive efficiency and clarity

To process a high volume of complex claims, carriers are replacing slow, outdated methods with digital tools that place critical information directly into homeowners' hands.

Digital communication is becoming the standard: A large number of carriers now offer modern communication methods: 55 percent of respondents said their carrier had a mobile app, 48 percent had access to an online claims portal, and 42 percent received the option to use direct texting capabilities for their claim.

Proactive updates: Only 23 percent cited a lack of proactive updates as a challenge, meaning more than three-quarters felt their carrier provided sufficient, timely information.

Frequent communication: Carriers are simplifying communication with digital tools, which is essential given that nearly one-third (31 percent) of homeowners contact their carrier four or more times over a three-year period, often during stressful recovery times.

"Claims are being handled faster, communication is clearer, and customer satisfaction is on the rise," added Allen. "While industry needs to ensure these improvements translate to long-term premium relief, Florida homeowners can be confident that the market's operational response, which is vital during hurricane season and beyond, is on the upswing."

To review additional findings and analysis, please visit: www.himarley.com/blog/florida-state-of-insurance-survey.

Methodology

Hi Marley surveyed 1,000 Florida homeowners who have filed an insurance claim in the past three years to understand their perceptions of the market's stability, the clarity of communication from their carriers, and their overall confidence in the system. The survey was conducted in October 2025 via Pollfish, an online survey platform.

About Hi Marley

Hi Marley is the first intelligent conversational platform built for P&C insurance and powered by SMS. Designed by insurance professionals, Hi Marley enables lovable, convenient conversations across the entire ecosystem, saving carriers money and time while building customer loyalty through delightful interactions. Hi Marley's industry-leading collaboration, coaching, and analytics capabilities deliver crucial insights that streamline carrier operations while enabling a frictionless customer engagement experience. The solution is made for the enterprise; it's fast to deploy, easy to use, and seamlessly integrates with core insurance systems. Through its advanced conversational technology, Hi Marley reduces friction and empowers innovative carriers to reinvent the customer and employee experience.

Learn more at www.himarley.com.

Contact:

Escalate PR for Hi Marley

[email protected]

SOURCE: Hi Marley

View the original press release on ACCESS Newswire

O.M.Souza--AMWN