-

Iran says would respond 'ferociously' to any US attack, even limited strikes

Iran says would respond 'ferociously' to any US attack, even limited strikes

-

New Dutch government sworn in under centrist Jetten

-

What the future holds for the CJNG cartel after leader killed

What the future holds for the CJNG cartel after leader killed

-

ICC kicks off pre-trial hearing over Philippines' Duterte

-

UN chief decries global rise of 'rule of force'

UN chief decries global rise of 'rule of force'

-

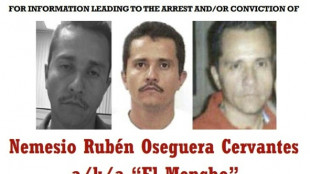

Nemesio Oseguera, the brutal Mexican drug lord known as 'El Mencho'

-

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

Senegal's Sahad, radiant champion of 'musical pan-Africanism'

-

New York orders citywide travel ban as major storm hits US

-

'Considered a traitor': Life of an anti-war Ukrainian in Russia

'Considered a traitor': Life of an anti-war Ukrainian in Russia

-

South Korea and Brazil sign deals on K-beauty, trade

-

Zimbabwe farmers seek US help over long-promised payouts

Zimbabwe farmers seek US help over long-promised payouts

-

Hong Kong appeals court upholds jailing of 12 democracy campaigners

-

India battle for World Cup survival after 'messing up on grand scale'

India battle for World Cup survival after 'messing up on grand scale'

-

'I will go': Bengalis in Pakistan hope for family reunions

-

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

North Korea touts nuclear advances as Kim re-chosen to lead ruling party

-

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

Hong Kong appeals court to rule on jailed democracy campaigners

-

Are Major LGBTQ Dating Apps a Hidden Privacy Risk?

-

Stewart Law Offices Ranked by Best Law Firms in 2026

Stewart Law Offices Ranked by Best Law Firms in 2026

-

SICPA Secures Major European Award for UK Vaping Duty Stamps Program

-

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

Apex Critical Metals Accepted into U.S. Defense Industrial Base Consortium (DIBC)

-

AGTech to Help Build One-Stop Trading Services Platform as Hong Kong Gold Exchange Opens for the Year of the Horse

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 23

-

Interim Funding Facility Update Appointment of Stanbic and CBZ as Co Lead Arrangers

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

Bonk, Inc. Completes 51% Revenue Interest Acquisition in $30M Asset Strategic Partner

Acquisition of 51% Revenue Stake Adds Significant Non-Dilutive Asset Value to Balance Sheet Based on Q3 Valuation Metrics

SCOTTSDALE, ARIZONA / ACCESS Newswire / December 3, 2025 / Following its announcement of a majority revenue interest acquisition in Bonk.fun, Bonk, Inc. (Nasdaq:BNKK) provided additional context regarding the financial impact of the transaction. Based on valuation metrics established in the Company's most recent quarterly filing, the expanded 51% revenue interest implies an asset value of approximately $30 million.

Proven Upside Potential While the current $30 million implied valuation is derived from recent Q3 reporting, the platform has demonstrated the ability to generate substantially higher cash flow during periods of heightened market activity. For example, in July 2025, Bonk.fun generated approximately $30 million in revenue.

Management notes that while digital asset markets are cyclical and revenue fluctuates with rising and falling market tides, this historical performance provides a clear benchmark for the significant economic value this 51% majority interest can unlock during favorable market cycles-offering upside far exceeding the current baseline valuation.

Non-Dilutive Growth Engine In its Q3 filing, Bonk, Inc. valued its initial 10% interest at approximately $3 million. This valuation metric implies a total value for the Bonk.fun asset of $30 million. By expanding its stake to 51% without a corresponding cash expenditure or equity issuance, Bonk, Inc. has executed a highly accretive, non-dilutive transaction that significantly strengthens the Company's balance sheet.

Revenue Generation "Our mandate is to identify and acquire undervalued, high-velocity assets that power the BONK ecosystem," stated Jordan Schur, President of Bonk, Inc. "Securing this majority revenue interest allows us to realize an implied asset value of approximately $30 million on our balance sheet without a single dollar of dilution. This is the kind of disciplined, accretive deal-making that will define Bonk, Inc. moving forward."

This move highlights Bonk, Inc.'s commitment to building a fortress balance sheet comprised of cash-flowing digital assets that support long-term shareholder value.

About Bonk, Inc. Bonk, Inc. (Nasdaq:BNKK) is a company evolving to bridge the gap between traditional public markets and the digital asset ecosystem. Through its subsidiary BONK Holdings LLC, the Company executes a strategy focused on acquiring revenue-generating assets within the DeFi space. The Company also operates a growing beverage division holding the patented Sure Shot and Yerbaé brands.

Investor Relations Contact: Phone: 888.257.8061 Email: [email protected]

Forward-Looking Statements: This press release contains forward-looking statements. Such statements are subject to risks and uncertainties, and actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, the performance of BONK digital assets, the operational success of the beverage division, market volatility, and other risks detailed in Bonk, Inc.'s filings with the Securities and Exchange Commission.

SOURCE: Bonk, Inc.

View the original press release on ACCESS Newswire

D.Moore--AMWN