-

Extensive destruction in Beirut's southern suburbs following Israeli strikes

Extensive destruction in Beirut's southern suburbs following Israeli strikes

-

'Super special' Allen can light up big occasion for New Zealand

-

'Genie' Bumrah: India's yorker king who carries a billion hopes

'Genie' Bumrah: India's yorker king who carries a billion hopes

-

'There will be nerves': India face New Zealand for T20 World Cup glory

-

Lufthansa warns of heightened 'uncertainty' from Mideast war

Lufthansa warns of heightened 'uncertainty' from Mideast war

-

Mideast war enters 'next phase' as strikes hit Iran, Lebanon

-

Sri Lanka denounces war deaths, houses Iran sailors

Sri Lanka denounces war deaths, houses Iran sailors

-

Inoue primed for 'historic' Nakatani clash in Tokyo

-

Italy challenges EU over key climate tool

Italy challenges EU over key climate tool

-

Home hero Piastri edges Antonelli in second Australian GP practice

-

Australia forces porn sites to block under-18s from Monday

Australia forces porn sites to block under-18s from Monday

-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

Aston Martin chief Newey says no quick fix to vibration problems

-

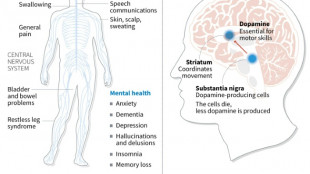

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

Iran missile barrage sparks explosions over Tel Aviv

-

Avio Signed $65m Contract for New Solid Rocket Motor Development Project in the USA

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 06

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 06

-

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Breaking Update - BOI Reporting is Back: New Filing Deadline Set for January 13, 2025

Recent regulatory changes have brought significant updates to the reporting obligations for companies filing beneficial ownership information with FinCEN. Following a federal Court of Appeals decision on December 23, 2024, reporting companies, except as indicated below, are once again required to file beneficial ownership information with FinCEN.

The Department of the Treasury recognizes that reporting companies may need additional time to comply, given the period when the preliminary injunction had been in effect. As such, the BOI reporting deadlines have been extended as follows:

Updated BOI Filing Deadlines:

Reporting companies created or registered before January 1, 2024: The deadline has been extended to January 13, 2025 (originally January 1, 2025) for filing initial BOI reports with FinCEN.

Reporting companies created or registered on or after September 4, 2024, that had a filing deadline between December 3, 2024, and December 23, 2024, now have an extended deadline of January 13, 2025.

Reporting companies created or registered between December 3, 2024, and December 23, 2024: These companies are granted an additional 21 days from the original filing deadline to file BOI reports.

Reporting companies created or registered on or After January 1, 2025: Must file BOI reports within 30 days of receiving actual or public notice of creation or registration.

Reporting Companies Qualifying for Disaster Relief: Deadlines may extend beyond January 13, 2025. Follow the later deadline that applies.

TaxBandits: The Solution for Timely and Stress-Free BOI Reporting

With BOI Reporting reinstated, businesses must begin preparing the necessary information to ensure the timely submission of their BOI reports. TaxBandits offers a comprehensive suite of features designed to facilitate accurate and on-time BOI filing for reporting companies, tax professionals, law firms, and service providers.

Key Features to Simplify BOI Reporting:

BOIR Protect: In partnership with Protection Plus, BOIR Protect provides peace of mind with a $1 Million BOI Filing Defense, covering potential errors or issues with filings for a full year.

Free Corrections or Updates: TaxBandits offers free corrections or updates for up to 7 days. Annual plan subscribers can file unlimited corrections or updates for one year.

Retransmit Rejected Returns for Free: When FinCEN rejects a BOI report, it can be re-transmitted without additional charges, ensuring prompt corrections and resubmission.

Easy Corrections: Update existing data and submit without needing to refile the entire report, saving time and ensuring accuracy.

Invite Beneficial Owners: Securely invite beneficial owners to complete their details via a secure URL, ensuring only authorized individuals can access and complete the necessary information.

AI-Based Data Extract: TaxBandit's AI-powered technology automatically extracts data from uploaded identification documents, eliminating the need for manual data entry and minimizing errors.

Schedule Filing: Prepare reports, schedule submission dates, and ensure automatic submission as planned. Reports can be edited multiple times before the scheduled date, minimizing the need for subsequent corrections or updates.

For CPAs and Service Providers:

TaxBandits' BOI reporting solution empowers tax professionals with features that drive efficiency. Compliance reminders, customizable engagement letters, and BanditConnect streamline reporting.

Secure Client Portal: BanditConnect provides a secure client portal for efficiently managing BOI filings. Businesses can customize the portal with their branding to enable seamless collaboration, secure data exchange, and an efficient review and approval process.

Team Management: The BanditCollab tool enables the invitation of unlimited team members, assignment of predefined roles, and delegation of BOI report filings. This ensures efficient workload management and timely completion of tasks.

Automated Reminders: Set up automated reminders for updates and upcoming deadlines from FinCEN, eliminating the need for manual follow-ups and ensuring timely action on all filings.

Custom Engagement Letter: Customize engagement letters with specific terms and conditions, auto-fill client details, request e-signatures, and update them at any time, ensuring a streamlined and efficient agreement process for BOI filing services.

Bulk Upload: Streamline BOI filings with the Bulk Upload feature! Use the standard CSV template to import data all at once, saving time and reducing manual effort.

Partnership Opportunities to Increase Revenue

TaxBandits provides an array of services tailored for large enterprises, accounting firms, and other businesses looking to expand their BOI reporting services.

Referral Program: Clients can participate in TaxBandits' referral program, obtain a referral link, incorporate it into their website or social media, and earn commissions for each completed filing.

API Integration: TaxBandits offers seamless API integration, enabling easy connection with existing business systems. This integration optimizes the BOI filing process by streamlining workflows and minimizing manual data entry, thus improving operational efficiency.

White-Label Solution: TaxBandits provides a white-label solution, allowing firms to brand the BOI filing platform fully as their own. This customization ensures businesses can offer a consistent and professional experience to their clients.

TaxBandits' BOI reporting solution empowers tax professionals with features that drive efficiency. Compliance reminders, customizable engagement letters, and BanditConnect streamline reporting. Watch the video to learn more about TaxBandits' BOIR filing solution and the original FinCEN requirements that have been reinstated:

About TaxBandits

TaxBandits is a SOC 2 Certified, IRS-authorized e-file provider specializing in various tax forms such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9, etc., and BOI reporting. Serving businesses, service providers, or tax professionals of every shape and size, TaxBandits offers a complete solution that fulfills all filing needs.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN has been developing industry-leading software tools for e-filing and business management tools for over a decade.

The SPAN Enterprises Portfolio of products includes TaxBandits, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Stephanie Glanville, Marketing Manager, at [email protected].

SOURCE: TaxBandits

C.Garcia--AMWN