-

Liverpool boss Slot says Isak in 'final stages of rehab'

Liverpool boss Slot says Isak in 'final stages of rehab'

-

Airbus ready to build two new European fighter jets if 'customers' ask

-

UN Sudan probe finds 'hallmarks of genocide' in El-Fasher

UN Sudan probe finds 'hallmarks of genocide' in El-Fasher

-

Costelow starts, Hamer-Webb makes Wales debut in Six Nations clash with Scotland

-

Facing US warnings, Iran defends right to nuclear enrichment

Facing US warnings, Iran defends right to nuclear enrichment

-

Ex-South Korea leader Yoon gets life in prison for insurrection

-

OpenAI's Altman says at India summit regulation 'urgently' needed

OpenAI's Altman says at India summit regulation 'urgently' needed

-

British couple held in Iran sentenced to 10 years

-

West Indies ease past Italy to tune up for T20 Super Eights

West Indies ease past Italy to tune up for T20 Super Eights

-

At least 16 killed after building collapses in Pakistan following blast

-

Summit photo op fails to unite AI startup rivals

Summit photo op fails to unite AI startup rivals

-

OpenAI's Altman says world 'urgently' needs AI regulation

-

Horror comics boom in our age of anxiety

Horror comics boom in our age of anxiety

-

Turkey fires up coal pollution even as it hosts COP31

-

London fashion week opens with tribute to one of its greats

London fashion week opens with tribute to one of its greats

-

Ex-S.Korea leader Yoon gets life in prison for insurrection

-

Pea soup, veggie mash contest warms up Dutch winter

Pea soup, veggie mash contest warms up Dutch winter

-

South Korea's Yoon: from rising star to jailed ex-president

-

Private companies seek to import fuel amid Cuban energy crisis

Private companies seek to import fuel amid Cuban energy crisis

-

India search for 'perfect game' as South Africa loom in Super Eights

-

India's Modi calls for inclusive tech at AI summit

India's Modi calls for inclusive tech at AI summit

-

Airbus planning record commercial aircraft deliveries in 2026

-

Elections under fire: Colombia endures deadliest campaign in decades

Elections under fire: Colombia endures deadliest campaign in decades

-

Traore backs 'hungry' Italy against France in Six Nations

-

All-rounder Curran brings stuttering England to life at the death

All-rounder Curran brings stuttering England to life at the death

-

South Korea court weighs death sentence for ex-president Yoon

-

Tech chiefs address India AI summit as Gates cancels

Tech chiefs address India AI summit as Gates cancels

-

Australia rejects foreign threats after claim of China interference

-

Somali militias terrorise locals after driving out Al-Qaeda

Somali militias terrorise locals after driving out Al-Qaeda

-

Peru picks Balcazar as interim president, eighth leader in a decade

-

Australian defence firm helps Ukraine zap Russian drones

Australian defence firm helps Ukraine zap Russian drones

-

General strike to protest Milei's labor reforms starts in Argentina

-

Cuban opposition figure Ferrer supports Maduro-like US operation for Cuba

Cuban opposition figure Ferrer supports Maduro-like US operation for Cuba

-

High-stakes showdown in Nepal's post-uprising polls

-

Asian markets rally after Wall St tech-led gains

Asian markets rally after Wall St tech-led gains

-

After Greenland, Arctic island Svalbard wary of great powers

-

Veteran Slipper set for new Super Rugby landmark

Veteran Slipper set for new Super Rugby landmark

-

Sudan's historic acacia forest devastated as war fuels logging

-

Deadly Indonesia floods force a deforestation reckoning

Deadly Indonesia floods force a deforestation reckoning

-

Australia vow to entertain in bid for Women's Asian Cup glory

-

Afghan barbers under pressure as morality police take on short beards

Afghan barbers under pressure as morality police take on short beards

-

Jail, disgrace and death: the dark fates of South Korean leaders

-

S. Korea court weighs death sentence for ex-president Yoon

S. Korea court weighs death sentence for ex-president Yoon

-

MotoGP dumps Phillip Island for Adelaide street circuit

-

Trump kicks off his 'Board of Peace,' with eye on Gaza and beyond

Trump kicks off his 'Board of Peace,' with eye on Gaza and beyond

-

Walmart results expected to highlight big plans for AI

-

Australia Olympic TV reporter apologises after slurring words

Australia Olympic TV reporter apologises after slurring words

-

Core Critical Metals Corp. Announces Acquisition of the Advanced Lucky Mike Silver-Copper-Tungsten Project

-

LSEG Launches Model-as-a-Service

LSEG Launches Model-as-a-Service

-

Formation Metals Appoints Roger Rosmus to Newly Established Advisory Board

Formation Metals Appoints Roger Rosmus to Newly Established Advisory Board

VANCOUVER, BC / ACCESS Newswire / February 19, 2026 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCQB:FOMTF), a North American mineral exploration company focused on advancing high-potential projects in tier-one jurisdictions, is pleased to announce the appointment of Mr. Roger Rosmus to the Company's newly formed Advisory Board. Mr. Rosmus, currently the Founder and CEO of Goliath Resources Limited, serves as the inaugural appointment to this board.

Mr. Rosmus brings over 25 years of experience in investment banking, corporate finance, and executive management within the resource sector. As the driving force behind Goliath Resources, he has a proven track record of building and leading successful exploration companies, particularly in precious metals. Under his leadership, Goliath Resources has advanced the flagship Golddigger project in British Columbia's prolific Golden Triangle, delivering multiple high-grade gold discoveries and attracting significant institutional investment. His expertise will be instrumental as Formation Metals scales its operations and enhances its strategic positioning in the junior mining sector.

This milestone appointment marks the first step in strengthening Formation Metals' strategic advisory capabilities as the Company accelerates exploration and development at its flagship N2 Gold Project ("N2" or the "Property") in Quebec's Abitibi Greenstone Belt, where the Company recently released the following assays from its fully funded 30,000 metre maiden drill campaign:

N2-25-005: 0.91 g/t Au over 42.3 metres beginning at 14.0 metres downhole, 9.9 metres vertical. Highlight intervals include 2.04 g/t Au over 8.1 metres and 1.31 g/t Au over 11.4 metres.

N2-25-012: 1.75 g/t Au over 30.4 metres beginning at 64.1 metres downhole, 45.3 metres vertical. Highlight intervals include 3.51 g/t Au over 10.5 metres and 19.2 g/t Au over 0.51 metres.

These wide, continuous near-surface intercepts validate the findings of the over 55,000 metres of historical drilling, significantly enhancing confidence in the geological model and reducing technical risk for future development. N2 is host to a global historic resource of ~871,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4 and is located 25 km south of Matagami, Quebec.

The assay results provide strong evidence for identifying further near-surface gold-bearing mineralization along strike and at depth, with N2-25-005 and N2-25-012 tracing a continuous mineralized zone nearly 100 metres apart that suggests excellent potential for an open pit resource. The drilling campaign has returned results exceeding historical averages, demonstrating both improved grade continuity and shallow mineralization.

"We are thrilled to welcome Roger as the founding member of our Advisory Board," said the CEO of Formation Metals. "Roger's deep understanding of the Canadian capital markets and his success in building value for shareholders at Goliath Resources Limited make him an invaluable asset. This appointment marks a significant milestone for Formation Metals as we begin to assemble a world-class team of advisors to support our growth trajectory."

The newly established Advisory Board will provide Formation Metals' executive team with strategic counsel on exploration, corporate development, and institutional outreach.

Roger Rosmus stated: "I am excited to join Formation Metals at this pivotal time. The N2 Project's location in the world-class Abitibi Greenstone Belt, combined with its historic resource base and ongoing drilling success, positions the Company for substantial upside. I look forward to contributing my experience in exploration strategy, capital markets, and stakeholder engagement to help drive the next phase of growth and work closely with the team to help unlock the full potential of their assets."

Project Summary

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of ~871,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~810,000 oz Au)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au)2.

There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that are being investigated for the first time by Formation with diamond drilling.

Phase 1 of its fully funded 30,000 metre drill program is comprised of 14,000 metres and is designed to:

Resource confidence and conversion: Infill shallow gaps to improve confidence in near-surface mineralization.

Resource growth: Test down-dip extensions and step-outs along strike to the west beyond the historic resource limits.

Metallurgy: Collect representative core for confirmatory test work to validate recoveries.

Targeting a conceptual open-pit resource, Formation is aiming to deliver a maiden mineral resource estimate post-Phase 1 in Q3, incorporating nearly 70,000 metres of drilling. Two drill rigs have been deployed to systematically test priority targets at the "A" and "RJ" Zones across over eight kilometres of strike, accelerating its program while evaluating multiple discovery targets across the corridor.

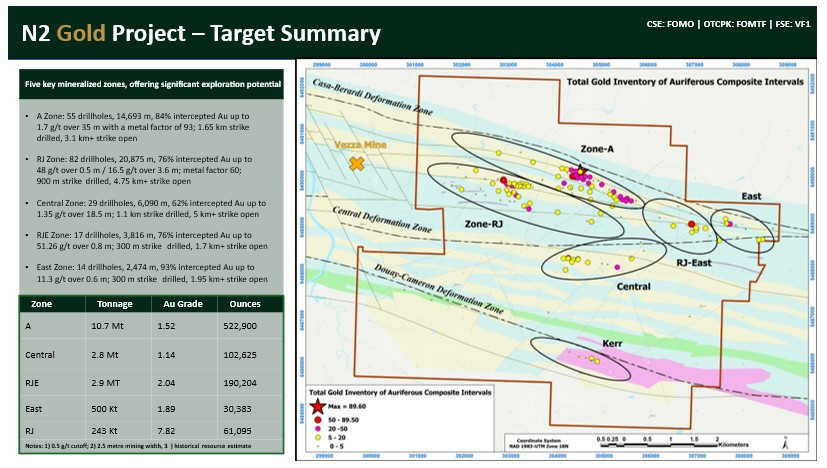

Historical highlights from the top two priority zones include:

A Zone: a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces identified at a grade of 1.52 g/t Au. ~15,000 metres have been drilled historically across 1.65 km of strike, with 84% of historical drillholes intercepted auriferous intervals including up to 1.7 g/t over 35 metres.

RJ Zone: a high-grade historic gold deposit with ~61,100 ounces identified at a grade of 7.82 g/t Au, with high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres and 16.5 g/t Au over 3.5 metres2. This zone was the target of the most recent drilling at the Property by Agnico-Eagle Mines in 2008, when the price of gold was ~US$800/oz. Only ~900 metres of strike has been drilled, with 4.75+ km of strike remaining to be tested.

The Company's internal view is that the N2 Project has the potential to host a potential open pit resource. This optimism is driven by several key factors:

Significant Undrilled Strike Length: The "A" Zone alone has >3.1 km of strike open (only ~35% drilled historically), while the RJ Zone has >4.75 km remaining untested - offering substantial room for lateral expansion of known mineralization.

Open at Depth and Along Strike: All zones remain open, with historical drilling limited to shallow depths (~350 m), leaving considerable vertical upside in a proven gold camp.

Wide, Continuous Near-Surface Intercepts: Recent drilling has confirmed thick zones (100-200+ m) of target mineralization starting near surface, ideal for bulk-tonnage open-pit scenarios with low strip ratios and high tonnage potential.

Regional Analogy and Pedigree: Located in the Casa Berardi trend, which hosts multiple multi-million-ounce deposits (e.g., Casa Berardi >2 Moz produced and 14.3 Mt @ 2.75 g/t Au P&P in reserve, Douay >3 Moz in resources (10 Mt @ 1.59 g/t Au indicated, and 76.7 Mt @ 1.02 g/t Au inferred), N2 shares similar geology and structural controls. Nearby Vezza produced from higher-grade underground mining, but N2's shallower, wider zones suggest superior open-pit economics.

Untested Targets: Compilation work identified numerous geophysical anomalies (IP, EM, VTEM) that remain undrilled, providing discovery potential beyond known zones.

Rising Gold Prices and Economic Viability: At current gold prices, lower-grade bulk-tonnage deposits become highly attractive, enhancing the project's upside.

Strategically located 25 km south of the mining town of Matagami, Quebec, this prime location provides year-round access via provincial highways and logging roads, proximity to skilled labor, power infrastructure, and established mining services in a jurisdiction known for its gold production exceeding 200 million ounces historically. The project lies along the Casa Berardi mine trend, which hosts multiple million-ounce gold deposits, and is situated approximately 1.5 km east of the former-producing Vezza gold mine operated by Nottaway Resources from 2013 to 2019 producing over 100,000 ounces of gold via underground methods.

The region's robust infrastructure supports toll milling opportunities, with potential access to nearby processing facilities such as those at Casa Berardi or other Abitibi mills, enabling cost-effective development without the need for on-site mill construction.

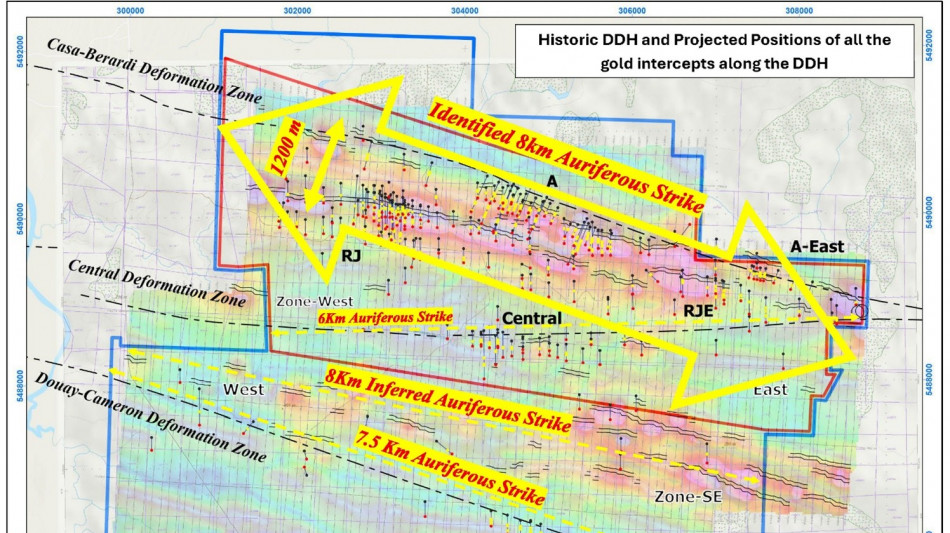

Figure 1 - Historic drillhole locations; Formation believes that there is over 15 kilometres of strike to explore at the N2 property.

Figure 2 - Property overview summarizing historical work completed at each of the six mineralized zones and their respective historical resource.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures, oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak V. Azar, P.Geo., géo (OGQ#10876) an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person.

Quality Assurance and Quality Control

The quality assurance and quality control protocols include insertion of blank or standard samples (accredited by Canadian Resource Laboratories) every 10 samples on average during the analytical process. The gold analyses were completed by fire assay (FA) method with an atomic absorption and ICP finish on 50 grams of materials at the Laboratoire Expert Inc. in Rouyn-Noranda, Quebec, Canada and AGAT Laboratories Ltd in Val d'Or, Quebec, Canada. The repeats were carried out by FA followed by gravimetric testing on each sample containing 10.0 g/t gold or more. Total gold analyses (metallic sieve) were carried out on the samples which presented a great variation of their gold contents or the presence of visible gold.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~871,000 ounces (18 Mt grading 1.4 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to historical high-grade intercepts as high as 51 g/t Au over 0.8 metres.

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email [email protected] or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting but not limited to: the Company's plans for the Property and the expected timing and scope of the drilling program at the Property; and the Company's planned 30,000-metre drilling program. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

SOURCE: Formation Metals Inc.

View the original press release on ACCESS Newswire

L.Durand--AMWN