-

EU presents plan to use Russian assets for Ukraine as Belgium frets

EU presents plan to use Russian assets for Ukraine as Belgium frets

-

Retail giant Costco challenges US tariffs in court

-

Principal reaction to 2027 Rugby World Cup draw

Principal reaction to 2027 Rugby World Cup draw

-

Man Utd boss Amorim 'protects' himself from abuse

-

Russia says battlefield success strengthening its hand in Ukraine talks

Russia says battlefield success strengthening its hand in Ukraine talks

-

Iran says to attend World Cup draw in apparent U-turn

-

Satellite surge threatens space telescopes, astronomers warn

Satellite surge threatens space telescopes, astronomers warn

-

Germany to host 2029 women's Euros: UEFA

-

Greek govt warns farmers not to escalate subsidy protest

Greek govt warns farmers not to escalate subsidy protest

-

Ski federation 'concerned' about Olympics snowboarding site delays

-

EU moves to break dependence on China for rare earths

EU moves to break dependence on China for rare earths

-

Celebrities back 'Free Marwan' campaign for Palestinian leader

-

Lebanon, Israel hold first direct talks in decades

Lebanon, Israel hold first direct talks in decades

-

FIFA gives clubs an extra week before releasing AFCON stars

-

Stocks dip after US jobs fall

Stocks dip after US jobs fall

-

EU agrees deal to ban Russian gas by end of 2027

-

Former king's memoirs hits bookstores in Spain

Former king's memoirs hits bookstores in Spain

-

Hong Kong fire death toll hits 159 after towers searched

-

Libya war crimes suspect makes first appearance at ICC

Libya war crimes suspect makes first appearance at ICC

-

Mass wedding brings hope amid destruction in Gaza

-

German lithium project moves ahead in boost for Europe's EV sector

German lithium project moves ahead in boost for Europe's EV sector

-

Russia, Ukraine prepare for more talks with US on ending war

-

Kohli, Gaikwad tons fire India to 358-5 in South Africa ODI

Kohli, Gaikwad tons fire India to 358-5 in South Africa ODI

-

'I feel like crying': Indonesians confront flood destruction

-

Lebanon, Israel hold first direct talks in decades: source to AFP

Lebanon, Israel hold first direct talks in decades: source to AFP

-

Stock markets mostly rise awaiting US data

-

Delhi records over 200,000 respiratory illness cases due to toxic air

Delhi records over 200,000 respiratory illness cases due to toxic air

-

South Korean prosecutors demand 15 years for former first lady

-

'Dream' draw for debutants Hong Kong against Wallabies, All Blacks

'Dream' draw for debutants Hong Kong against Wallabies, All Blacks

-

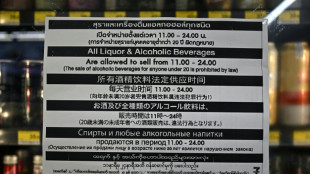

Thailand lifts ban on afternoon alcohol sales

-

Norway postpones deep-sea mining activities for four years

Norway postpones deep-sea mining activities for four years

-

Sri Lanka cyclone survivors face colossal clean-up

-

Zara owner Inditex posts higher profits

Zara owner Inditex posts higher profits

-

Australia meet New Zealand as S. Africa face Italy at Rugby World Cup

-

YouTube attacks Australia's world-first social media ban

YouTube attacks Australia's world-first social media ban

-

France's Macron in China with Ukraine on the agenda

-

South Korea's ousted leader urges rallies a year after martial law

South Korea's ousted leader urges rallies a year after martial law

-

KFC readies finger-licking Japanese Christmas

-

Stokes backs 'incredibly talented' Jacks on eve of 2nd Ashes clash

Stokes backs 'incredibly talented' Jacks on eve of 2nd Ashes clash

-

Airbus cuts delivery target over fuselage quality issue

-

Stokes 'hit hard' by death of England batting great Smith

Stokes 'hit hard' by death of England batting great Smith

-

EU agrees deal to ban Russian gas by autumn 2027

-

South Korea overcame 'crisis', leader says year after martial law

South Korea overcame 'crisis', leader says year after martial law

-

Ukraine war fuels debate on neutrality in Austria

-

UK seniors fight loneliness with tea and a tango

UK seniors fight loneliness with tea and a tango

-

How anti-China disinformation shaped South Korea's year of crisis

-

Indian rupee hits fresh record low past 90 per dollar

Indian rupee hits fresh record low past 90 per dollar

-

Thunder beat Warriors to bag 13th straight win, Celtics down Knicks

-

Five-wicket Duffy puts New Zealand on top against West Indies

Five-wicket Duffy puts New Zealand on top against West Indies

-

US, Russia find 'no compromise' on territory after Ukraine talks

Stocks dip after US jobs fall

Wall Street's main stock indices dipped on Wednesday after data showed US businesses unexpectedly shed jobs last month.

The US private sector shed 32,000 jobs in November, according to payroll firm ADP, compared to a small gain expected by analysts.

The jobs numbers reinforced concerns over the health of the US economy, which has struggled with dislocations and price rises caused by tariffs introduced by President Donald Trump's administration.

The Dow dipped by less than a tenth of a percentage point at the opening bell, while the S&P 500 shed 0.2 percent and the tech-heavy Nasdaq dropped 0.5 percent.

Tech stocks were weaker, with shares in the so-called Magnificent Seven largest tech firms down 0.3 percent overall. Shares in Microsoft were down 2.8 percent.

The surprise drop in employment underpinned expectations that the US Federal Reserve will cut interest rates next week.

"The justification for a rate cut next week centres around weakness in the (US) jobs market," noted Joshua Mahony, chief market analyst at trading group Scope Markets.

Money markets have put the chances of the Fed cutting interest rates on December 10 at nearly 90 percent.

Lower interest rates make it easier for companies and consumers to borrow money, and thus the prospect of Fed rate cuts tend to boost stocks.

Optimism over US rate cuts won an additional boost from reports that Trump's top economic adviser Kevin Hassett -- a proponent of more reductions -- is the frontrunner to take the helm at the Fed when Jerome Powell's tenure ends in May.

While a number of bank decision-makers have thrown their hat in the ring for a reduction, there remains differences on the policy board about the need to target the soft labour market or stubbornly high inflation.

With a cut to US interest rates expected, trading has softened ahead of key indicators this week that could still play a role in the central bank's planning over the next year.

The Fed's preferred gauge of inflation -- personal consumption expenditure (PCE) index -- will be released on Friday.

Investors see the Fed cutting rates three times next year, which has been a factor weighing on the dollar.

A recovery in Bitcoin has also helped support equity markets.

"A continued bounce in bitcoin and other cryptocurrencies has stoked a renewed speculative bid," said Briefing.com analyst Patrick O'Hare.

Bitcoin is back above $90,000. It plunged below $83,000 last month after having set a record high of $126,251 in October.

European stocks were just below the break-even point in afternoon trading.

Asian stock markets mostly rose Wednesday.

The pound was up 0.7 percent against the dollar on UK data showing stronger than expected British services sector activity.

Stronger sterling weighed on London's benchmark FTSE 100 stock index, which features major companies earning in dollars.

Elsewhere, the Indian rupee weakened past 90 per dollar for the first time, extending declines through the year as New Delhi struggles to strike a trade deal with the United States.

- Key figures at around 1440 GMT -

New York - Dow: DOWN less than 0.1 percent at 47,434.68 points

New York - S&P 500: DOWN 0.2 percent at 6,841.32

New York - Nasdaq Composite: DOWN 0.5 percent at 23,315.58

London - FTSE 100: DOWN less than 0.1 percent at 9,696.83

Paris - CAC 40: DOWN less than 0.1 percent at 8,069.52

Frankfurt - DAX: DOWN less than 0.1 percent at 23,697.98

Tokyo - Nikkei 225: UP 1.1 percent at 49,864.68 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,760.73 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,878.00 (close)

Euro/dollar: UP at $1.1657 from $1.1622 on Tuesday

Pound/dollar: UP at $1.3296 from $1.3209

Dollar/yen: DOWN at 155.50 yen from 155.86 yen

Euro/pound: DOWN at 87.68 pence from 88.00 pence

Brent North Sea Crude: UP 0.7 percent at $62.89 per barrel

West Texas Intermediate: UP 0.8 percent at $59.12 per barrel

burs-rl/tw

D.Cunningha--AMWN